Weekly Newsletter

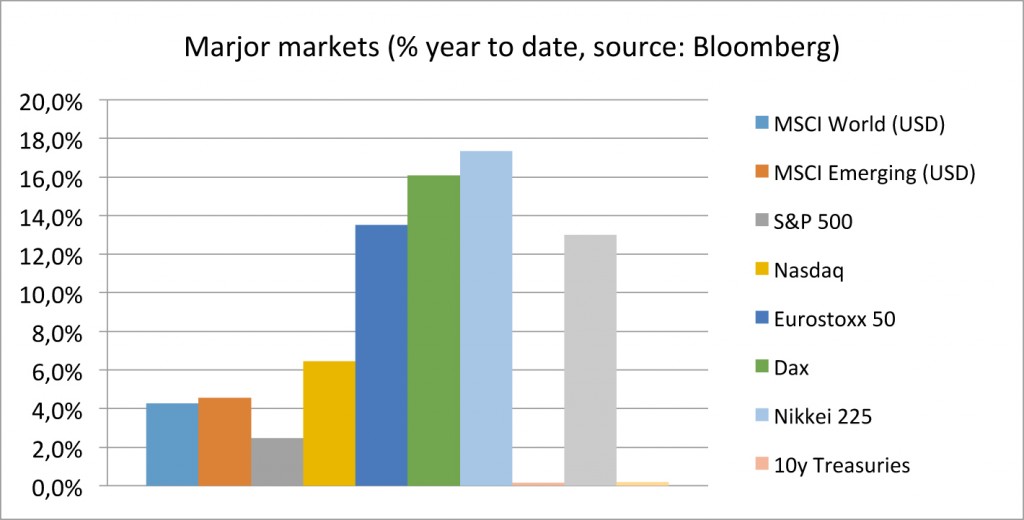

Global Markets have little changed since our last report two weeks ago. We do not expect this to change over summer time and will reduce our newsletter frequency to twice a months until we see a wake up or even shake up.

However what we do not change is our effort to continuously look for the best investment opportunities for our clients and arrange products accordingly. So if you want to see more products just let us know. We will add you to our list for weekly updates.

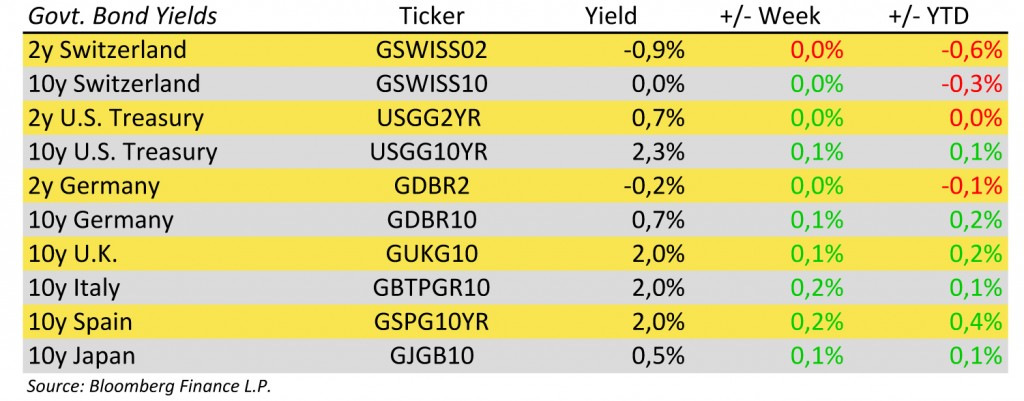

So what were the most exciting news this time? The ECB has defeated inflation. It accelerated its 1.1 trillion-euro ($1.2 trillion) bond-buying program in May. And finally Ecostat reports a positive consumer price index again. Unfortunately this causes for investors in European bonds a loss for the first time in 2015 according to the Bloomberg Eurozone Sovereign Bond index. German government bonds held onto their biggest drop since 2012 Wednesday before European Central Bank. See also our chart of the day!

Do we get inflation now? We don’t think so. Though it looks impressive how consumer prices turned around right after ECB buying bonds. We think it takes a lot more for inflation, particularly real growth, optimism and wage increases. Though we see growth an optimism for INNOVATIS Erwin Lasshofer does not see considerable wages increases in the near future – not for Europe and unfortunately for INNOVATIS neither. So we think without major structural reforms there will be no growth and no significant rates hikes in Europe.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login