Weekly Newsletter #17/2015

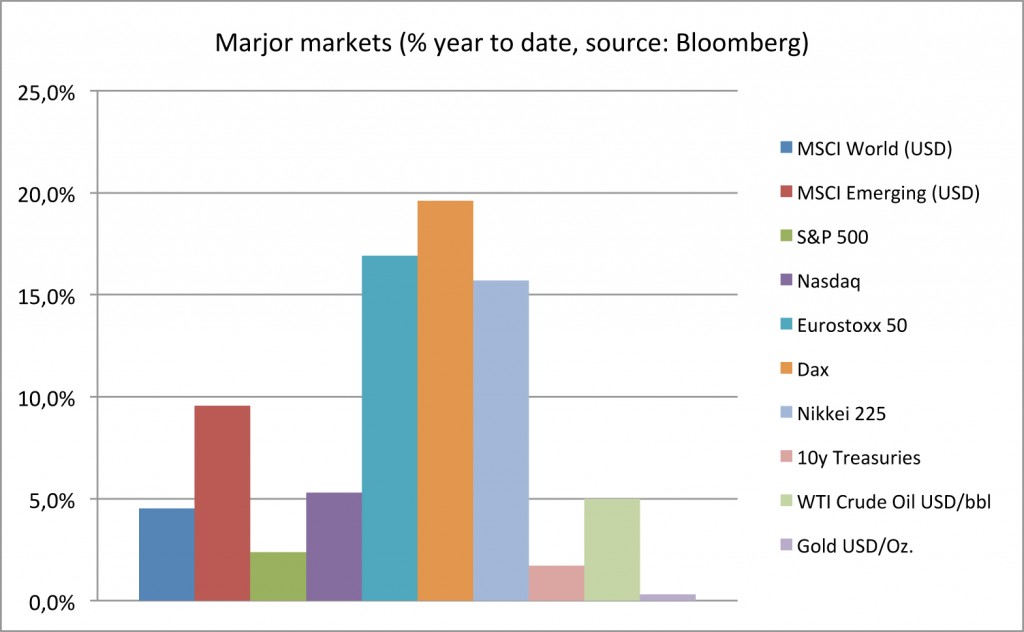

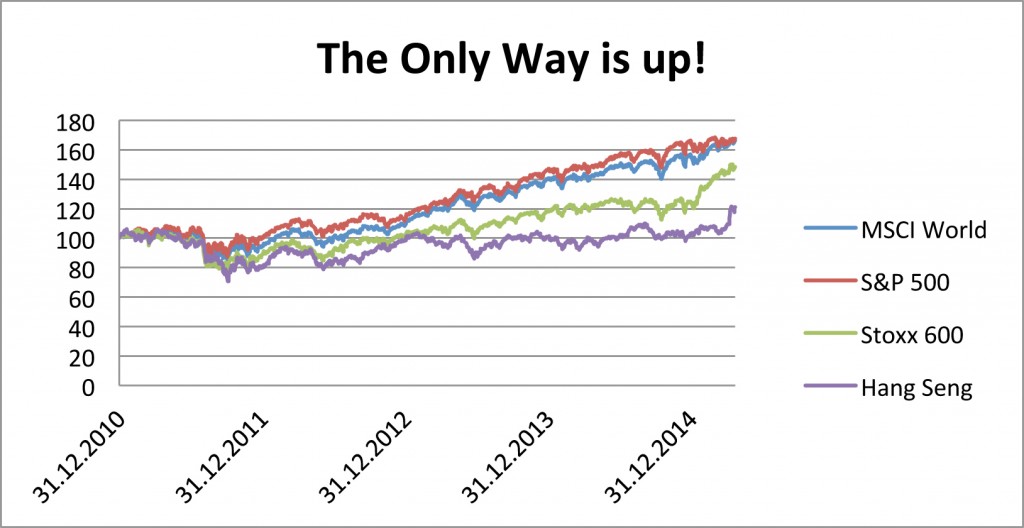

What would you expect a risk-market to do, if the investors are confronted with weak economic data?! Well, I bet you first answer is, that you expect the market to go down. And that is the only logical answer you can give. But in nowadays markets you probably would not win a lot of money with your answer. Cause investors are acting in an environment, which is heavily controlled by central banks. In former times central banks policy was intended to flatten the extremes of the economic cycle, to keep inflation and economic growth in a reasonable window. Nowadays central banks propagate, that they are still doing the same. But nearly everyone is aware of the fact, that central banks measures act as artificial support for the markets these days and have nothing to do with the tasks they had in mind a few years ago.

The economy and the data from the market have become much more unimportant to the market participants. It is more important if central banks maintain interest rates as low as possible and provide huge amounts of liquidity to the markets, pushing the quotation of the risk markets higher and higher. So you don’t really care if economic data are bad, as long as you can be sure, that bad economic data would cause central banks reaction to increase or maintain the support for the market. So bad news are actually good news for investors in this case. Central banks are the real kings of the market. “Long live the King”. Cause if he dies, the awakening will be very painful.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login