Weekly Newsletter #15/2015

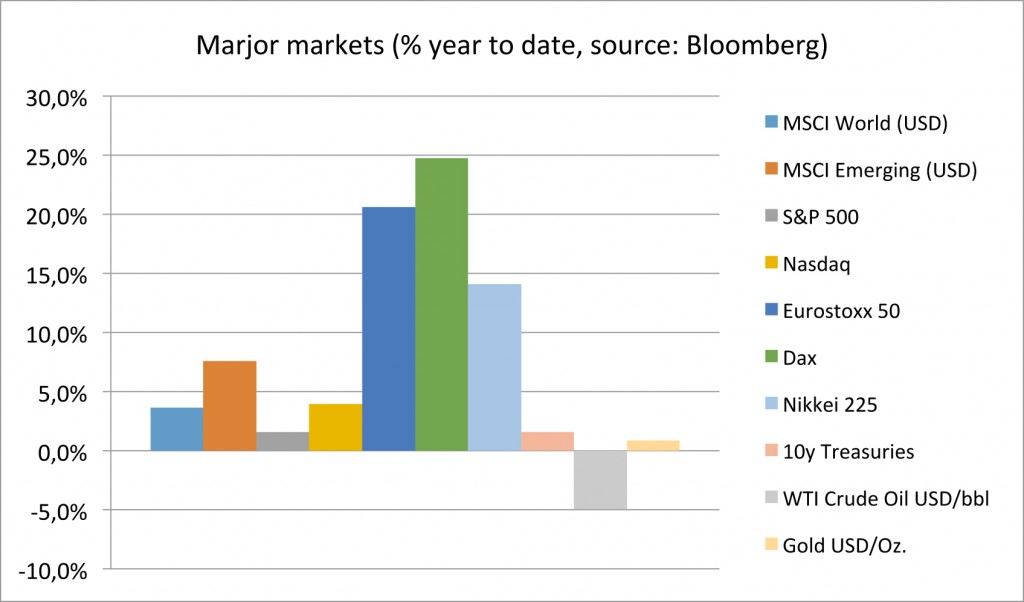

Last year US stocks lead the pace among global equities with S&P500 gaining +11% and Nasdaq100 +18%. Year to date European stocks have been the big winner. The EuroStoxx50 index made +18% just during the first quarter. So where is the money heading now? Currently it looks like Emerging Markets are waking up.

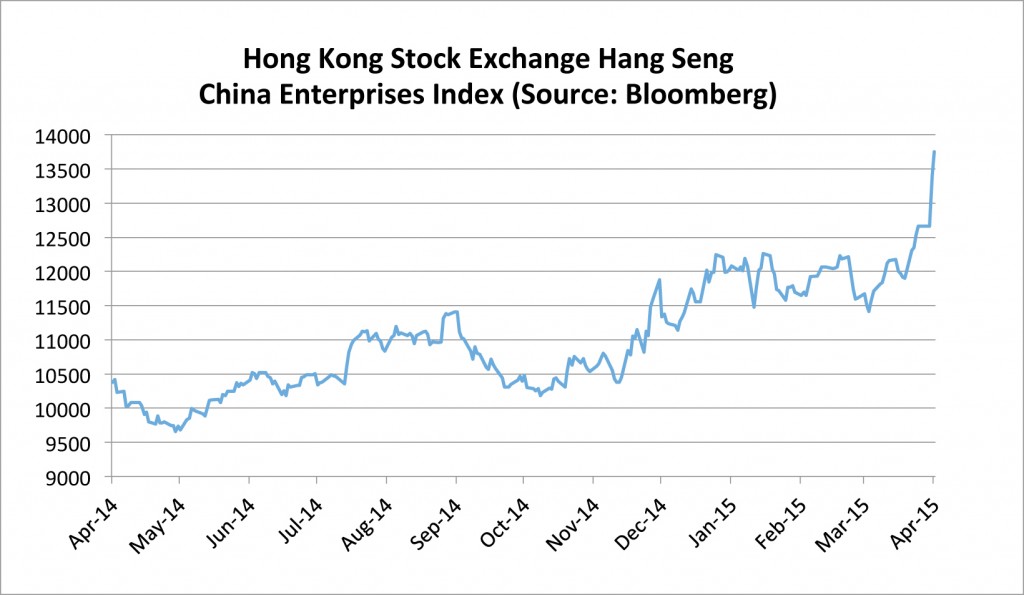

This is quite remarkable since most Emerging markets are still trading at late 2009 levels. Also Chinese stocks have not been moving for 5 about years except for the last few weeks! Now the Hong Kong Stock Exchange Hang Seng China Enterprises Index has gained +21% during just one month – see also our chart of the day! This index is a free-float capitalization-weighted index comprised of H-Shares listed on the Hong Kong Stock Exchange and included in the Hang Seng Mainland Composite Index. Erwin Lasshofer and his INNOVATIS team offers products based on Emerging Markets stocks or indices. See one example below including the HSCEI.

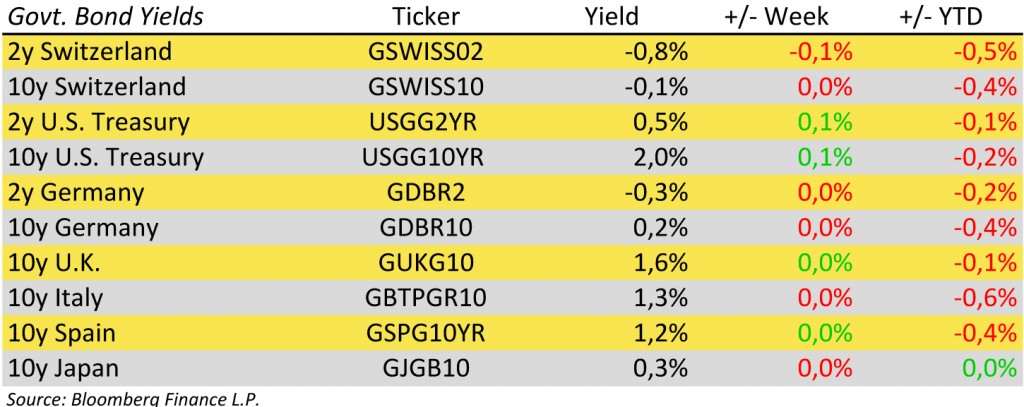

So where are we heading now? Look at the rates for government bonds in our table. For major currency you get not more than 2% p.a. for up to ten years. In many cases it is around zero or even less! This compares to an earnings yield of 4.0% for developed and 7.5% for emerging equity markets. There is a strong positive trend in most equity markets with short term or all-time highs. We expect set backs in the short run. For the long term we see many investors without alternatives joining the equity party. We think this is a great time to create smart structured products that combine advantages of calculable bonds cash flows with atrractive equity returns and help to time the markets for you.

| Charts of the Day |

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login