Weekly Newsletter #12/2015

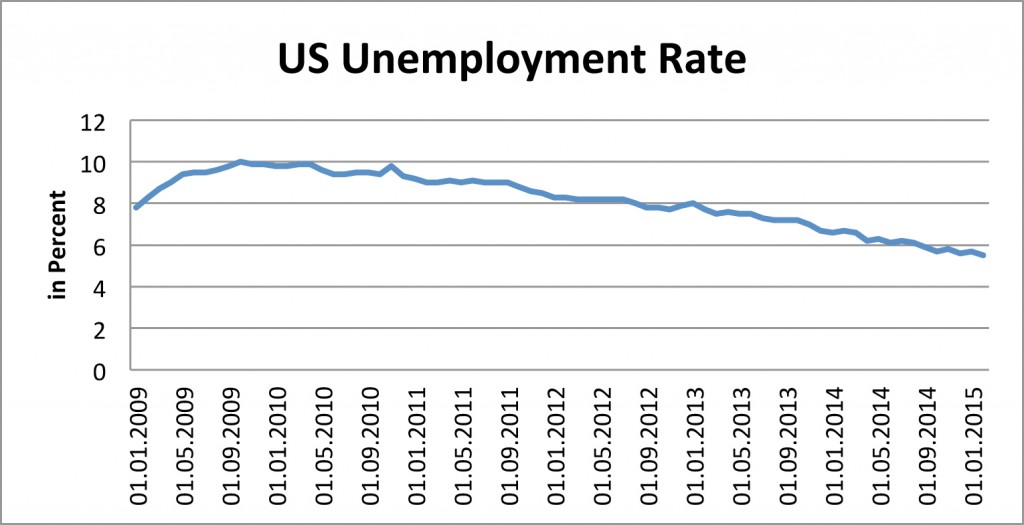

In the opinion of the Fed the strong US Dollar does reflect the strength of the US economy. In our opinion it reflects the high expectations regarding the US economy. And the Fed did not get tired to fuel those expectations with all their positive comments in regard of the US economy over the last few months. But yesterday this expectations took a hard hit, with the Fed slashing its own projections for interest rates. For the end of this year the officials lowered their projections by almost the half from 1.125% to 0.625%. So we are really talking about an strong revision in their opinion. And the market had a similar assessment of this move. The US Dollar fell 1.7% against the 10 major peer currencies, the most since 21 months. The Fed states, that a rate increase in April is pretty unlikely now but June should not be ruled out. Anyway. the US is in the midst of an inofficial currency war, with being in the worst position by having a really strong currency now. International competitiveness of their economy is suffering and a rate hike would not improve the situation, even if the strong US dollar already includes a lot of high expectations Ð especially in regard of the interest rate developement. So the FED will really have to be cautious in raising the rates, cause in the current environment and with all the QE measures around the world higher interest rates will for sure cause an even stronger flow of assets into the US dollar, making the strength of the greenback an even worse topic for exporting companies.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login