Weekly Newsletter #14/2015

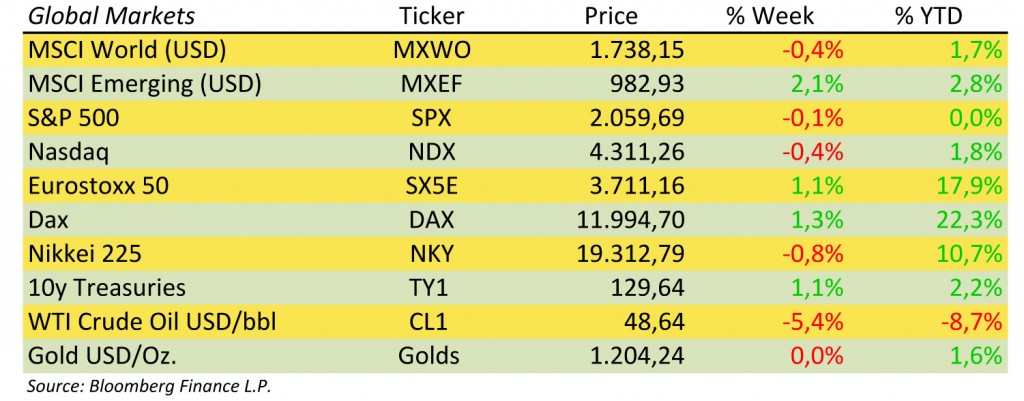

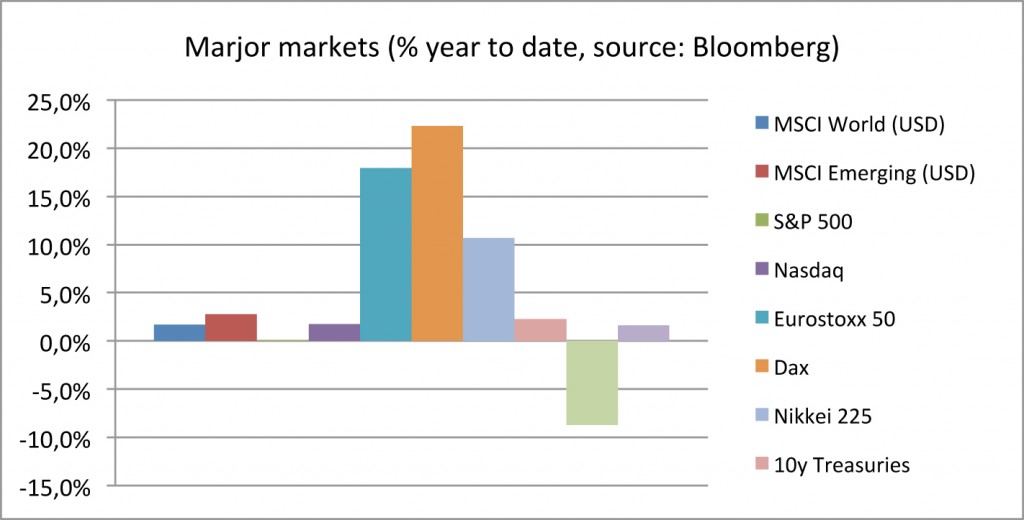

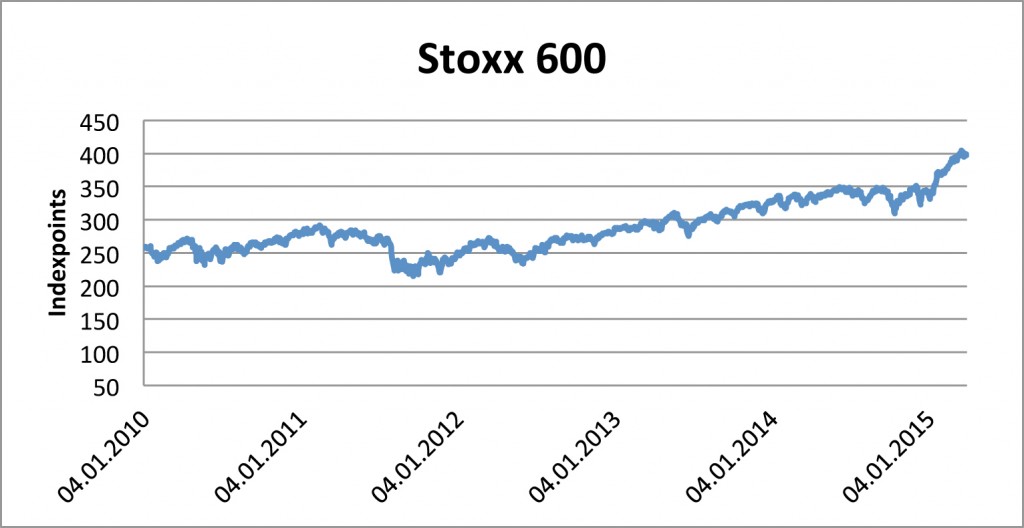

The first quarter of 2015 is over and especially the European equity markets had a tremendous start into the new year. The Stoxx 600 rose over 16% in the first quarter. This is a pretty amazing performance for just 3 months, especially if you compare this to the S&P 500, which only made about a percent in the same time. But what are the reasons for this strength of the European markets? Basically it are the positive surprises in regard of the economic data. This has to be relativized, cause Europe is still anything else than a economic locomotive in a global context. And the data are still far away from being really good in total, so that Europe will need quite a while to catch up with the US for example. Nevertheless it is the trend that feeds the market with optimism, the trend of showing better data than expected. Investors not only want to see growth, they want to see improvement that is stronger than expected. That is one of the basic principles of the financial markets where asset prices for a greater part are defined by expectations . In regard of the european economic landscape further improvements are possible. Especially the low Euro with the ECB starting QE measures and the low oil price are factors, that could deliver positive impulses to the European economy. So 2015 could be a really good year for European equities. The good momentum of European names out there can be used in structured products as well. Mr. Erwin Lasshofer and his team would be pleased to deliver you some ideas in this regard.

| Charts of the day |

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login