Weekly Newsletter #19/2015

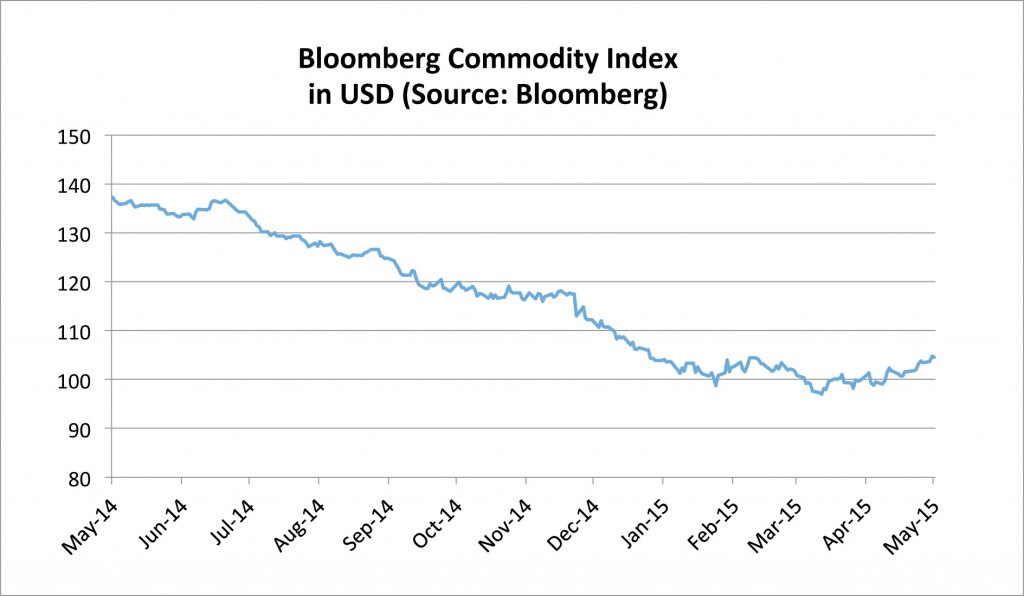

The dollar sank and U.S. stocks fell to a one-month low after data on jobs and productivity added to concern economic growth is not robust enough. U.S. crude stockpiles fell by 3.88 million barrels last week while most analysts predicted an increase in supplies. Refineries operated at the highest rate in four months as imports slipped to a one-year low. Raw-material prices have rebounded since reaching a 12-year low in March as crude rallied, the dollar fell and speculation increased that China may bolster economic stimulus. See also our chart of the day!

So what is the big investment picture now? Investors take profits and rotate their money from the recent top gainers such as bonds and equities to laggers or losers such as energy and industrial commodities. Markets are still driven by huge liquidity from central banks around the world. Currently investors weigh every word from central banks particularly from U.S. Fed which is the largest player in this game. Both global growth and inflation are low, U.S. growth is slowing down.

Erwin Lasshofer and his INNOVATIS team still sees no need or reason for U.S. Fed to make any U-turn soon. And for a large market correction or crash it takes a lot more anyway. It takes the unexpected. Thus is important to be flexible, to have access to a large range of investment solutions and to manage your portfolio actively. For this reason INNOVATIS offers Managed Accounts at preferred partner banks or can deliver a managed strategy as a Managed Index Certificate to your home custodian.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login