Weekly Newsletter #18/2015

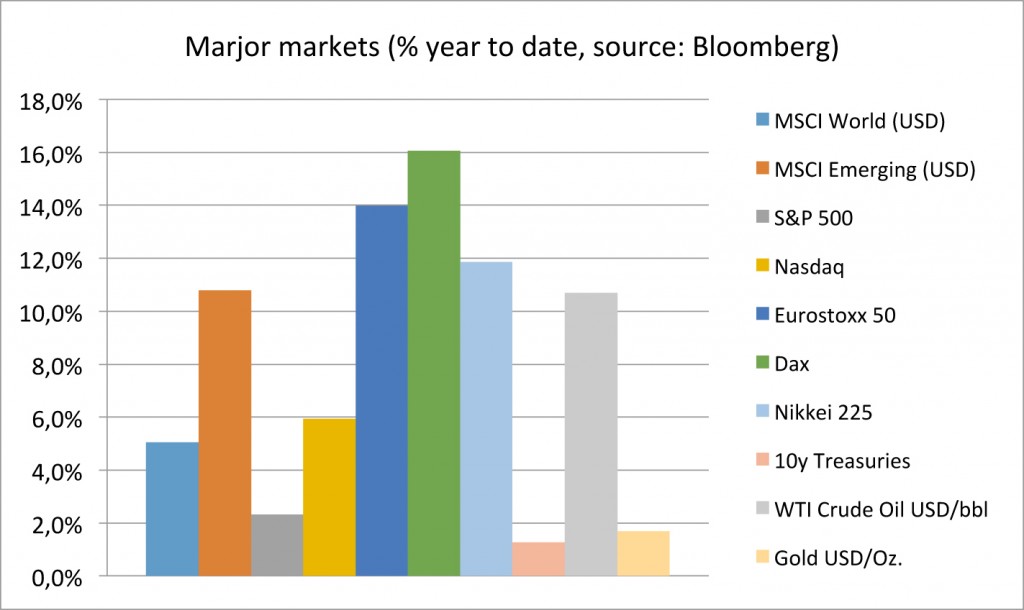

After reaching new record highs global equity markets have been experiencing a slight correction. US GDP growth was a disappointing 0.2% for the first quarter this year. Market analysts expected 1.0% after reported 2.2% and 5% in the quarters before.

Slow US growth raises the questions for US interest rates hikes again. US Fed left Target Rates unchanged and did not give guidance any change. So what rates is the market currently trading for the near term? As of end 2015 and based on US forward rates the market is trading a rate increase of about 25 bps for maturities below 5 year and virtually no change for maturities of 10 years and more. As of 3 years from now the short end is expected to increase to about 2% p.a. while maturities of 10 year and more yield about 2.7% p.a. See our chart for current and expected yield curves in 1, 2 and 3 years.

Erwin Lasshofer and his INNOVATIS team do not expect significant rates any time soon. Our reasoning is based on a strong US Dollar and low crude prices. Now GDP growth is slowing down – faster than expected. If this persists there is even less need or reason for rate hikes.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login