Newsletter dated March 09, 2017

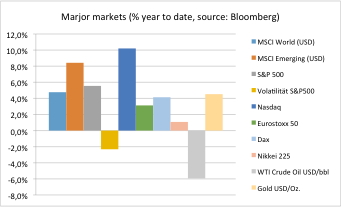

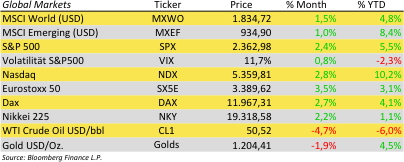

Global financial markets have still been heading to new record levels. The Dow Jones Industrials reached 21’000 and the broader S&P500 reached 2’400 index points – for the very first time in history. This might have been the trigger for Federal Reserve Chair Janet Yellen to single out the danger of the central bank being too slow in boosting rates. She left little doubt on Friday that the central bank will raise interest rates this month. More importantly, she dropped hints that it might end up having to increase them this year more than planned.

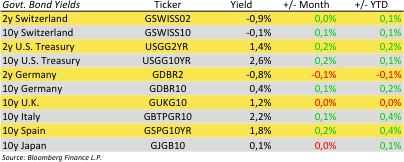

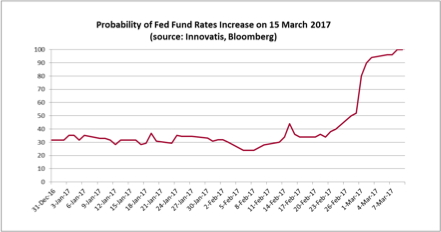

A subtle change of her words in her assessment of the current stance of monetary policy from “modestly accommodative” in January to “moderately accommodative” seems to be the code that there will be a rate hike at the next meeting on March 15th. According to forward rates market participants updated their expectations for a Fed Fund Interest Rate increase from about 30% few weeks ago to nearly 100% recently. See also our chart of the day!

According to the central bank’s Beige Book economic report the economy grew at a modest to moderate pace across the U.S., further tightening the labor market but without significant acceleration in wages or inflation, a Federal Reserve survey showed. Some districts reported “widening labor shortages,” indicating full employment. Several policy makers said the central bank is close to achieving its dual goals of bringing unemployment to its lowest sustainable level and inflation to 2 percent.

Erwin Lasshofer and his INNOVATIS team continue to expect that the US Fed will curb any boom in equity markets by taking the chance to increase interest rates back to ’normal’. Thus we see better opportunities in structured products than in equity markets. Ask us for our Managed Account for an easy and convenient access to these instruments while keeping full control of you funds in your own account.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login