Newsletter dated January 26, 2017

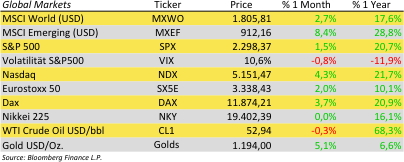

Global equities gained around the world. The Dow Jones Industrial Average topped 20,000 for the first time. Strong corporate earnings fueled investor optimism in economic growth.

Investors are also encouraged by early indications of U.S. President Donald Trump’s pro-growth policies including possible infrastructure projects, approving two oil pipelines and pushing American carmakers to building plants in the U.S. He promised a “very major” border tax, signed an executive orders to withdraw the U.S. from the Trans-Pacific Partnership trade deal and announced he’d seek to renegotiate the North American Free Trade Agreement.

The U.K. economy grew faster than economists forecast in the fourth quarter, continuing to defy expectations that the Brexit vote would derail the expansion. Prime Minister Theresa May plans to start formal talks on leaving the EU by the end of March. She has indicated that she wants to withdraw from the bloc’s single market for goods and services, an outcome that economists say will hurt trade. However, the Supreme Court has ruled that parliament must give its consent before the government can trigger article 50 and formally initiate Brexit. This allows for some extra time and influence to the rather pro-EU MPs.

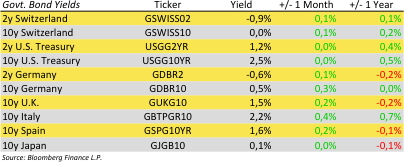

Erwin Lasshofer and his INNOVATIS team see some pick-up in global economic growth. We also see some populistic and protectionistic dynamics that might attract followers and imitators. This supports inflation and (in a healthy economic environment) should lead to higher interest rates. We expect no straight way there and a recovery of volatility.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login