Newsletter dated December 15, 2016

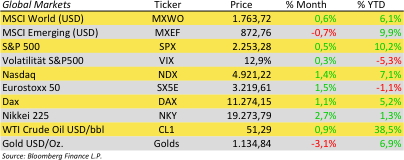

Major US indices have rushed to new record levels such as the Dow Jones Industrials approaching 20’000 index points. Gold and US Treasuries dropped. The US Dollar soared.

What has happened?

US Federal Reserve raised interest rates (by a quarter point) for the first time this year and forecast more steps in 2017. Inflation expectations have increased “considerably” and suggested the labor market is tightening. Still, the U.S. central bank stands largely alone in tightening policy. The Bank of England kept its key rate at a record low similar to policy makers in Norway, South Korea and Switzerland. The European Central Bank last week extended quantitative easing through 2017.

Accordingly the dollar climbed to the highest level since 2003 against the euro. European banks rallied to near an 11-month high on bets that higher rates will make lending more profitable. U.S. 10-year yields reached the highest level in more than two years, while 30-year bunds led a decline in German securities.

What will 2017 bring?

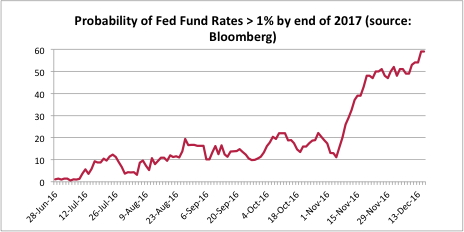

While the recent rate hike has been widely expected as virtually certain the probability for future increases has grown significantly too. See our chart of the day illustrating the probability of a rate increase to more than 1% which equals at least two more steps from now until the end of 2017. Federal Reserve Chair Janet Yellen said the central bank is operating amid a “cloud of uncertainty” about budget policy under Donald Trump but one thing is clear: The labor market doesn’t need fiscal stimulus any more.

Currently the investor’s world believes Trump will boost economy with a trillion Dollar fiscal program. While Republicans are said to be unwilling to further increase public debt we have just heard that US Fed also might fight such plans – e.g. by further rate increases.

How does INNOVATIS invest in this situation?

Erwin Lasshofer and his INNOVATIS think the amazing change from fear to economic hope in the face of Trump’s election is slightly overdone. We do see a strong positive influence from a recovering US economy on the rest of the world. Despite the persistent heterogeneous trends US economy will not decouple from the rest of the world. Thus growth and inflation will be curbed by slow global economy. Overall we do see a moderate sideways market to continue which provides a great investment environment for structured products, particularly in the category yield enhancement.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login