Newsletter dated November 17, 2016

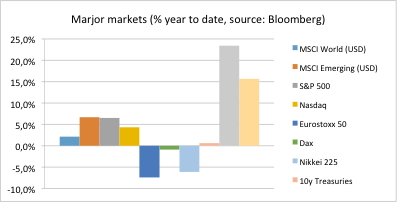

After the shock of Donald Trump’s election as the 45th US president markets are returning to daily business. Despite some temporary turbulences when the message hit markets sending indices down nothing much has happened. This is what we expected – see our special (Investment Blog Update on Presidential Elections). Since the beginning of the month or even of the quarter most indices and prices are nearly unchanged.

However, the US-Dollar seems to be an interesting exception. In recent weeks it gained significantly and just reached a record level for more than a decade. In our chart of the day you can find the US Dollar Index representing the exchange rates versus a large basket of major currencies in the world. We take a closer look what’s behind.

Since currencies are relative prices there are two sides of the coin: US and non-US developments. The major reason is to found in the US. Markets price in the prospects for higher growth and inflation after the surprise election of Donald Trump. Currently they expect an interest rate hike in December at a probability of over 90% which seems to be almost certain.

Outside the US markets have continued to expect that the European Central Bank and the Bank of Japan will maintain highly stimulative policies, despite the prospects for a less dovish Fed. This leads us to overall higher interest rate differentials triggering further capital flows. The recent dollar strength support a global economic rebalancing. Currently the US is the only locomotive of growth in the world economy. An increased US buying power due lower foreign currency prices will boost imports and divert some economic activity to those countries. However, upcoming protectionism might destroy more wealth than available for redistribution.

Erwin Lasshofer and his INNOVATIS team expect the US Dollar to stay volatile until the future economic agenda is defined and effect become visible. We offer currency hedging for our clients and offer a great choice of investment currencies.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login