Newsletter dated December 2, 2016

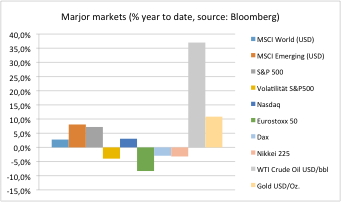

The major U.S. stock indexes have continued their post-election rally and reached new record highs. The Standard & Poor’s 500 index passed 2’200, the Dow Jones Industrials went above 19’000.

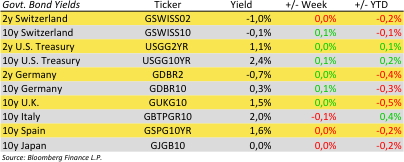

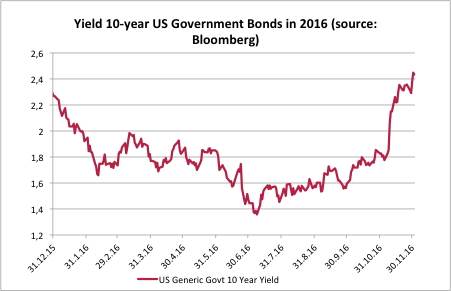

At the same time US interest rates jumped. See yield for 10-year US government bonds in our chart of the day! Since mid-year the yield has increased from 1.5% to 2.4%. Some investors already wonder if this move might be the beginning of a turn-around from the 30-year down trend of interest rates.

Calling an end to the three-decade bond bull market is no longer looking like unthinkable. The Federal Reserve is expected to start raising interest rates and inflationary expectations are climbing.

In the face of Donald Trump’s election win – with promises of tax cuts and $1 trillion in infrastructure spending – many bond investors are reevaluating their asset allocation and switch from bonds to stocks.

More inflationary pressure should arise from increasing commodity and energy prices. The Organization of the Petroleum Exporting Countries (OPEC) surprised the world by agreeing to its first production cut in eight years. After a harmonious meeting in Vienna Oil prices jumped 10 percent. Saudi Arabia and Iran came to an agreement. And even Russia is working with OPEC together after nearly doubling its crude oil output over the last 20 years! Overall this can be considers a remarkable revival if OPEC considers being dead for several years. The OPEC and Russia account for about half of the global crude oil production.

How do we invest in this situation? For the switch from bonds to stock we do not have to worry so much as long we are invested in structured products combining the advantages from both worlds. In general we can benefit from a higher yield and volatility level. In particular we are continuously researching all kind of market opportunities. Currently we are holding a significant amount of crude oil related investments.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login