Weekly Newsletter dated October 20, 2016

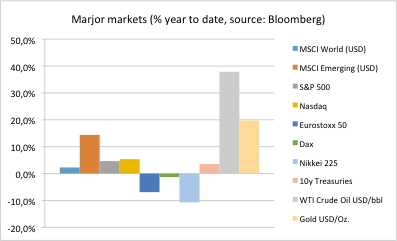

Markets are nearly the same level as they were at our last report two weeks ago. Crude oil has continued to gain after Russia is going to join OPEC’s efforts to support global crude oil prices by curbing production. Saudi Arabia is offering a $15 billion-plus bond deal trying to diversify away from its dependence on crude revenue. The debt offering also comes at a time when the kingdom has been hit hard by the long period of low oil prices and the costly war in Yemen.

This amount of money is not far from the $18 billion private market value of Snapchat after its last funding round. Snapchat, now Snap Inc., offers sharing selfies and videos, watching news videos and chatting with friends. It has more than 150 million daily active users and aims to generate more than $350 million in advertising revenue this year. The IPO is scheduled for March next year, lead by Morgan Stanley and Goldman Sachs. Erwin Lasshofer and his INNOVATIS watch this going public closely since it can provide an indicator for market sentiment. We rather think of the peak of tech bubble in 2000 than the IPOs of Google or Facebook in this case.

Is inflation coming back? Some analysts say so. Inflation expectations traded by US swap markets show a significant increase from 1.5% to 1.9% during recent six weeks. See also our chart of the day!

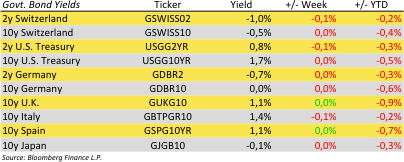

Accelerating inflation should be the trigger for interest rates hikes the US Fed is waiting for. However, Fed Chair Janet Yellen said the central bank might want to let inflation run hotter for a while, pointing out that the economy had seen an unusual tendency for weak demand against strong supply. Currently markets are still trading a 65% probability for a rate hike by the end of the year.

Erwin Lasshofer and his INNOVATIS team expect an increase by 0.25% in December and no further step by June 2017. We think it is a great time for structured notes since upside risk of equities is curbed by central banks and overall corporate and sovereign yield levels are still far too low for being attractive.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login