Newsletter dated February 23, 2017

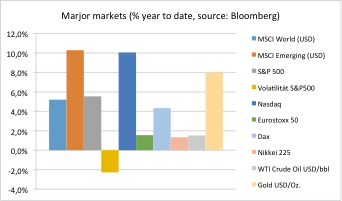

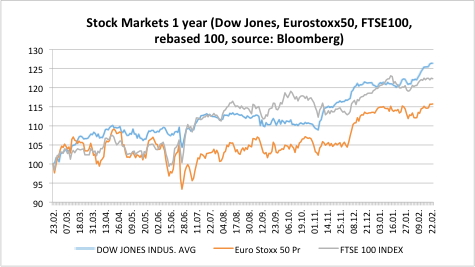

Major indices continued to rally to new record levels. Mainly U.S. indices traveled into uncharted territory, helped by a round of robust economic data and ongoing optimism that President Donald Trump will cut corporate taxes. Bigger-than-expected rises in retail sales and consumer prices in January reinforced confidence that the economy is growing at a solid pace following the strongest quarterly corporate earnings growth in over two years. Trump repeatedly said he would lower taxes substantially and simplify the tax code.

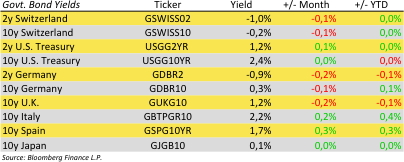

And investors did not get nervous when Federal Reserve Chair Janet Yellen confirmed before the House Financial Services Committee that the U.S. central bank was on track to raise interest rates at an upcoming policy meeting. Obviously they are confident enough about the fundamentals.

In contrary Federal Reserve policymakers have shown considerably uncertainty in their planned timing of this year’s interest rate hikes because of a lack of clarity on the new Trump administration’s economic program. According to the recently published Fed minutes, “participants again emphasized their considerable uncertainty about the prospect for changes in fiscal and other government policies as well as about the timing and magnitude of the net effects of such changes.”

Speaking about uncertainty, the Bank of England is unlikely to predict the next financial crisis, according to one of the central bank’s leading policymakers, who said economic models were unable to provide flawless forecasts for the UK economy. He told Members of Parliament in a debate on economic effects of Brexit: “We are probably not going to forecast the next financial crisis, or forecast the next recession. Our models are just not that good.”

Erwin Lasshofer and his INNOVATIS team welcome both the straightforward analysis of economic reality of uncertainty by leading economists and the existence of uncertainty in financial markets itself. Uncertainty and risk aversion are the foundation of superior returns for investors willing and capable to take some risk. We tailor for our investors products with exactly the type and amount of risk that meets their needs. In a Managed Account we design, pick and manage a portfolio of structured notes with superior balance of high returns and low risks for our clients.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login