Newsletter dated February 9, 2017

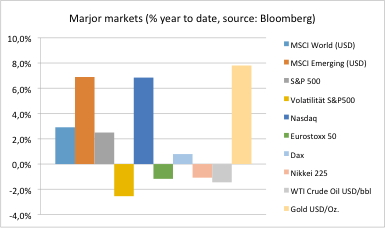

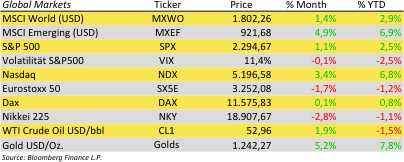

Financial markets are nearly unchanged: good earnings season, solid figures from leading economies around the world, plenty of cheap money, equity markets at record high and volatility at record low.

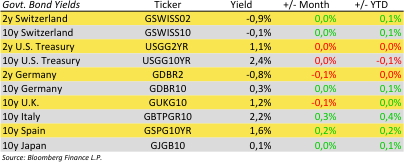

So no reason to worry for investors? If you are looking for risks you should consider interest rates spreads within EU that are increasing again – namely in France, Italy and Greece. The French election is getting messy. Le Pen, who would attempt to drive France out of the European Union, leads the way with about 25 percent of the vote in recent polling. The Italian economy and its banking system are failing to reach the post-crisis levels that other euro members have achieved. Greece’s two-year yield has climbed above 9 percent to its highest level since the middle of last year. The International Monetary Fund wants European officials to grant more debt relief for Greece which will be more and more difficult in the face of elections looming in France and Germany.

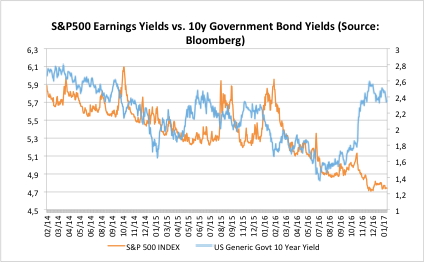

Investors should also take a closer look at the decreased spread between stock and bond markets. See our chat of the day for S&P500 earnings yields and 10-year U.S. government bond yields. There is a long-term downward overall trend for both yields over the 3-years chart window and far beyond. However in recent weeks the U.S. government bond yield have soared while the earnings S&P500 earnings yields (= company earnings / stock prices) are still close to record lows. The reduced spread means a lower risk premium and/or an expected jump in future earnings by about 20%.

U.K. is on its way to Brexit. Prime Minister Theresa May overcame early efforts to amend the bill allowing her to begin Brexit negotiations. Her ministers will not be required to give parliament regular Brexit updates and May does not need to work with the U.K.’s devolved governments in Scotland, Wales and Northern Ireland. She said she wanted to invoke the exit trigger by the end of March.

Donald Trump is on his way to chaos. On his eighth day in office, President Trump signed an executive order banning the U.S. entry of people from seven Muslim-majority countries. The move sparked outrage from all parts of the country including leading Silicon Valley companies. Another big headline is the battle between Trump and Enrique Pena Nieto, the president of Mexico, America’s third-largest trading partner. A central theme has been the idea that Mexico is stealing American jobs and that the policies of a Trump administration will bring them back buy building a wall and imposing a punitive tax. Economists argue that the drop of the Mexican Peso caused by this policy might attract even more business to Mexico due to decreased costs.

Erwin Lasshofer and his INNOVATIS team expect overall market volatility to increase in the near future. By then we focus on picking superior underlyings and exploiting opportunities by active management – e.g. in our Managed Account.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login