Newsletter dated September 12, 2017

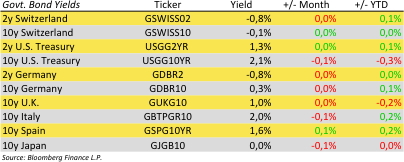

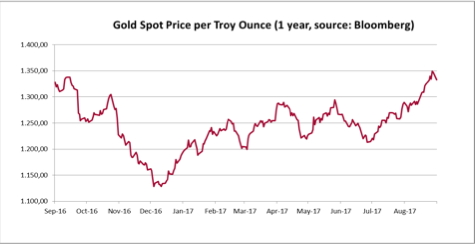

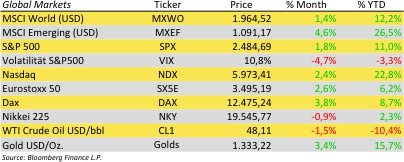

During the last 4 week markets have not been as quiet as many investors expected them to be in a typical summer. In fact we have seen some more political turbulences and an overall excellent earnings season. Versus our last report in early August US and European stocks are higher while crude oil is slightly lower. The biggest winner are Emerging markets and Gold. The Euro continued to gain versus US Dollar.

Earnings reports for the second quarter exceeded expectations by almost 5% for the S&P500 index. Earnings grew 9.6% and revenues 5.0% in the second quarter versus same quarter last year. In every sector, at least half of the companies have surpassed or met expectations, with many also getting a boost from a sinking U.S. dollar. In terms of growth and surprise the quarter has marked a record of several years. Europe has shown similar results with strong demand from Emerging markets.

There were several factors preventing markets from greater price gains despite positive earnings surprise yet. Of course there were two hurricanes paralyzing everyday life in Texas and Florida. The economic effects are still not calculated. Second. the ECB has continued to evaluate adjustments of its monetary policy for the near future. Currently we expect an announcement for late October. They might significantly effect EU interest rates levels, global currency prices and accordingly export business. Third, and probably the worst factor weighing on risky assets has been the growing tension between the US and North Korea both trading nuclear threats. After Donald Trump’s warning that North Korea faced “fire and fury like the world has never seen” North Korean Kim Jon-un continued to make threats against the US. Meanwhile many people have called for Twitter to ban Trump for violating community standards against hate speech and harassment. Trumps unthoughtful public announcements often touch national security. Sometimes US Pentagon will wonder if they are currently attacking North Korea – without knowledge of the action.

Trump economic agenda is under pressure as well. The IMF has adjusted its 2017 and 2018 growth forecast for the United States downward, and it has urged the US government to finally address pressing problems such as the aging of society, flagging growth and the unequal distribution of income. The Economic and Financial Committee of the EU criticizes US restrictions on free trade and international cooperation as an attack on economic world peace, but also as a detriment to the United States itself. Growing protectionism would put both global and US growth at risk.

Erwin Lasshofer and his INNOVATIS team see attractive opportunities for the near future. Currently we do see a great economic basis for markets in the near future has not been fully incorporated into current prices yet. Political tensions are put growth at risk. However, they can be solved. We rely on our capability to exploit opportunities for our clients in any market environment. The easiest access for clients is our managed account based on structured products.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login