Newsletter dated July 14, 2017

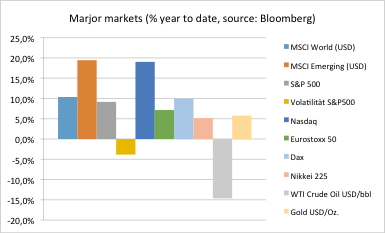

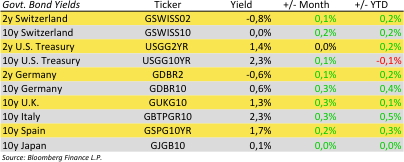

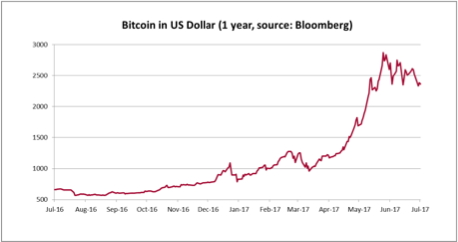

Financial markets have experienced a moderate technical correction since our last report. Overall stocks are nearly the same level versus 3 weeks ago. Crude oil and gold are still lower. Yields of major governments are slightly higher. We have entered summer season, with few financial news. Let’s take a look at one of this year’s financial rockets: Bitcoins. See also our report one year ago.

The digital currency have roughly quadrupled for the last 12 months. See also our chart of the day for the price of one Bitcoin in US Dollar. So is there a major breakthrough of the currency in trading real goods? The quick answer is no. The long answer sees usage of Bitcoins for daily payments rather decreasing. Bitcoin is accepted at just three of the top 500 online merchants. Transactions become slower and more costly. The high volatility is adding to transaction costs. Bitcoins turn out to be more an asset than a currency. Thus some call it internet gold.

Bitcoin is the millennial generation’s apocalypse insurance. Crypto-currencies are marketed as a direct expression of opposition to central-bank and government policy. In fact, crypto-currencies are booming in the environments of financial instability. That’s why in Venezuela the demand for digital coins is soaring. Triple-digit inflation, currency devaluation and political crisis provide one of the highest potentials for Bitcoin adoption in the world, according to the London School of Economics. The other top country is Argentina.

Financial markets have been trying to catch up in offering related products. The first investment funds are hitting markets. In Switzerland the first bank has just been authorized to let clients access, acquire, hold and liquidate Bitcoin directly through their e-banking platforms or account managers, and monitor holdings in custody directly in online portfolios or as part of standard account statements. They offer Bitcoin asset management to clients and even will install a Bitcoin ATM in Zurich.

Erwin Lasshofer and his INNOVATIS team repeat our outlook from one year ago: We see a huge potential for a technological and financial revolution here. It is certainly big enough to be taken very seriously. It will change the way we pay and thus the financial sector. For the next few years we see no direct effect on the way we design structured products. However, we will watch this development closely and select underlyings accordingly.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login