Newsletter dated June 26, 2017

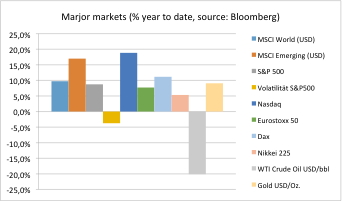

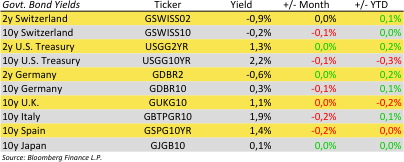

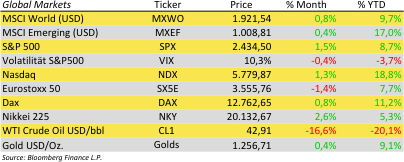

Same picture as every report: Financial markets keep going. US stocks reaching new all-time highs. Other equity indices are close or at least trending higher. Yields are nearly unchanged. Crude oil lower – see also our analysis in our last report.

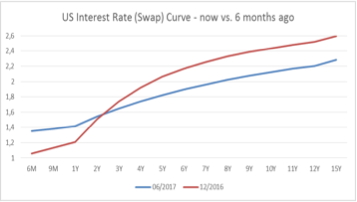

The US Fed has increased interest rates by 0.25 percent. The rate hike had been widely expected – so no surprise here. Let’s take a look at our chart of the day to see what happened to US interest rates (curves) over the last 6 months. Interest rates increased on the short end which is strongly controlled by Fed Fund rates. However, on the long end (5-15y) interest rates are lower now then 6 months before. Normally the long end is driven by investor’s expectations regarding economic growth and accordingly inflation. The ‚risk free rate‘ is an important benchmark for equity investments and takes strong influence on major valuation methods. In this context lower rates suggest lower valuation and rising potential for stock investments and any other kind of future cash flows.

Lower rates (long end) lead to higher bond prices. This promotes US Fed plans to start reducing its portfolio of more than $4 trillion in bonds later this year. The Fed said it would initially shed $10 billion a month for three months. It will then raise until reaching $50 billion a month. However, selling bonds may push rates higher and thus weigh on growth and inflation. In recent years the Fed has been consistent in predicting faster inflation — and in being wrong. The Fed conceded it was overly optimistic in predicting stronger inflation this year. In recent economic forecasts Fed officials predicted that prices would rise by just 1.6 percent this year, down from a forecast of 1.9 percent in March. So plans to sell down the overloaded balance sheet are at risk.

Last but not least Fed chairwoman Yellen may soon lose her role as the conductor of the Fed’s slow, steady and successful retreat. Her term ends in early February. And President Trump said on the campaign trail that he would “most likely” pick a new person. Ms. Yellen’s management of monetary policy may matter less than her disagreements with Mr. Trump about regulatory policy and Mr. Trump’s preference for people he knows.

Erwin Lasshofer and his INNOVATIS team expect no big growth or inflationary pressure, limited capability to get down US Fed balance sheet, some flexibility to react on negative developments by lowering rates again. If Trump messes the US Fed up, we are ready to take advantage from increasing volatility for our clients. Do not hesitate to check for our managed account!

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login