Newsletter dated May 8, 2017

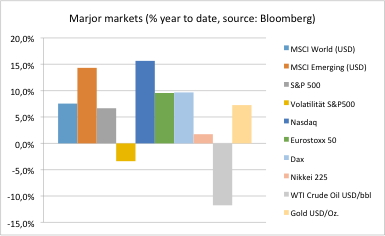

Equity markets have gained as much as 5% versus our newsletter two weeks ago, interest rates are nearly unchanged while gold and crude oil went down.

The biggest gain has come from Europe this time – celebrating the results of the first round of French presidential elections. Centrist Emmanuel Macron and far-right leader Marine Le Pen will go head to head in the French presidential runoff on May 7. Recent surveys see Macron winning the runoff by more than 60 percent. Although the result is a massive rejection of the ruling establishment, it is a pro-EU vote sparking a relief rally led by EU stocks, and in particular by the banking sector.

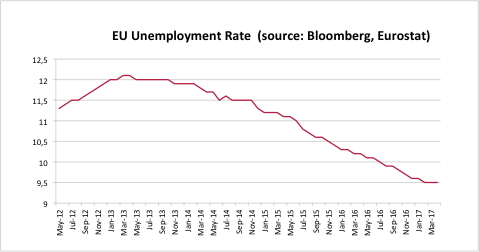

The EU economy presents itself increasingly in good shape. ECB president has characterized the euro-area recovery “solid and broad”. Unemployment is steadily declining from a peak of more than 12 percent in 2013, with improvements also visible in crisis-hit countries such as Spain. See also our chart of the day!

Better chances of finding a job make consumers more willing to spend. Euro-area economic confidence hit its highest in a decade in April, and an index of consumer sentiment is close to its strongest reading since before the financial crisis.

Stricter budget constraints in many member countries have caused the eurozone’s combined public deficit drop to levels last seen in 2008. The dip was caused mainly by decreasing government spending, Eurostat reported. The level of government borrowing across the 19-member eurozone has fallen to 1.4 percent which is the lowest level since the global financial crisis. While core inflation shows the strongest in almost four years, the ECB cautioned that price growth still lacks a convincing upward trend.

By contrast the US Fed is one step ahead signaling the next interest rate hike for June 2017. Currently the Fed funds futures indicate a 97 percent chance of a June interest-rate hike. Accordingly investors take this step for sure after latest comments by Fed officials.

Erwin Lasshofer and his INNOVATIS team see a moderate economic growth in a still fairly unstable political environment. This offers attractive investment opportunities based on structured products. The easiest way for our clients to benefit from our active management is the managed account.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login