Newsletter dated March 23, 2017

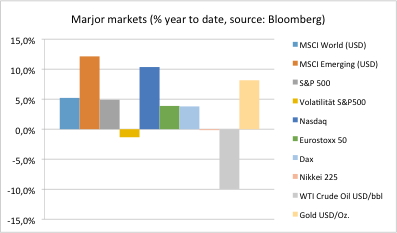

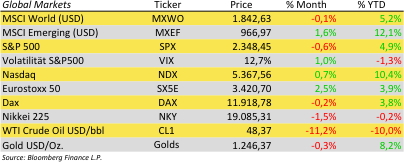

Currently the financial markets rally has come to a halt so far. Market volatility is still low. There have been view events. The U.S. Fed has raised interest rates by a quarter percentage point.

„U.S. economy is doing well.” According to Federal Reserve chairwoman, Janet Yellen, the economy will keep growing just enough to put more Americans back to work, but without overheating to generate excessive inflation. American workers will see gradual pay raises that keep compensation rising faster than inflation. Interest rates will rise gradually, while staying low by historical standards.

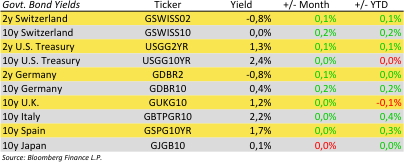

The message is: It will remain the slowest cycle of interest rate increases in modern history. Ms. Yellen evinced little fear that the Fed is behind the curve. She suggested no urgency toward a tightening of the money supply, suggesting that two more interest rate increases are on the way over the remainder of 2017. The central bank’s policy committee said it aims for „symmetric” 2 percent inflation and would be equally displeased by inflation that was too high or too low. That implies that the Fed is not inclined to overreact to the possibility that inflation could drift slightly above 2 percent in the coming months. After the announcement, the interest rates on Treasury bonds actually fell. That implies that markets were ready for signals of even more aggressive rate rises.

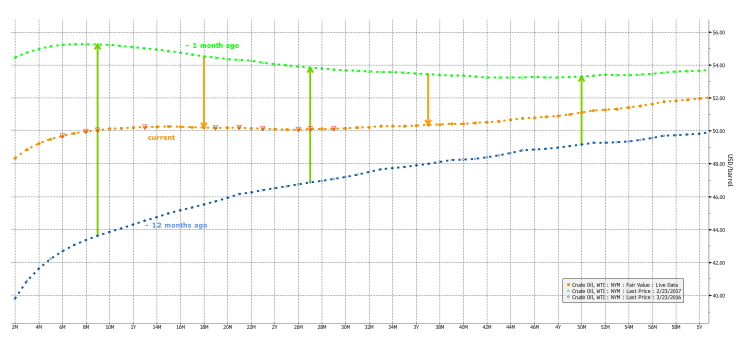

Oil dropped further below $50 after concerns that OPEC’s output cuts aren’t tempering a surplus in the U.S. triggered the biggest slump in more than a year. Currently the price for a barrel WTI crude oil is 10% below its level at the beginning of the year. The shale oil industry in the U.S. has made great strides to cut costs. The number of U.S. oil rigs in operation has been increasing from 371 to 631 within the last 12 months. The futures contract curve has turned from „contango” (low current and higher future prices) to „backwardation” one month ago it has come back to a nearly flat shape now – see our chart of the day for crude oil futures curve now, 1 month and 12 months ago!

One reasonable economic interpretation is that oversupply in the short term seems to be over. Few weeks ago there has even been a lack. So yes, the OPEC deal on production cut has made a significant change in the overall stock situation. However the U.S. is still ramping up production at increased price levels.

Erwin Lasshofer and his INNOVATIS team expect new equilibrium could be found at current levels near $50 per barrel. We still find opportunities in the energy sector although having lowered our overall exposure.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login