Newsletter dated September 22, 2016

Stocks and bonds rallied in Asia and Europe on Wednesday, advancing with commodities after central banks including the Federal Reserve indicated monetary policies will remain accommodative. US Fed left interest rates unchanged and scaled back its projections for hikes in 2017 and beyond.

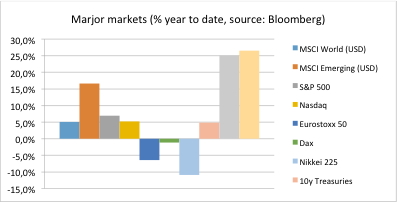

Despite mounting opposition inside and outside the U.S. central bank Fed Chair Janet Yellen delayed an interest-rate increase again to give the economy more room to run. According to interest rate future markets the probability of an interest rate increase by the end of this year has increased to 61% recently versus as low as 8% in June of this year. See also our chart of the day.

Erwin Lasshofer and his INNOVATIS team see liquidity by central banks as a key driver for global markets. Current moderate growth prospects give central banks worldwide room for monetary stimulus while inflation remains under control. We continue to expect market upside potential to be limited since US Fed would curb significant growth by rate hike. On the downside we do see some room for further stimulus. In this environment we see superior opportunities for active management based on structured notes.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login