Newsletter dated August 11, 2016

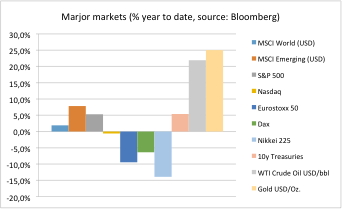

The crude oil price dropped 10% versus our last newsletter two weeks ago. Accordingly Gold is the sole leader on a year-to-date level now. See also our special investment blog on Gold we issued last week.

Among equities Emerging Markets has continued to gain. A closer look at local markets shows that although China rather has not changed Brazil, Thailand and Indonesia have gained significantly in both currency and local equity indices on a year-to-date basis.

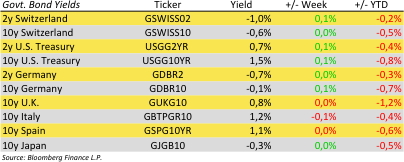

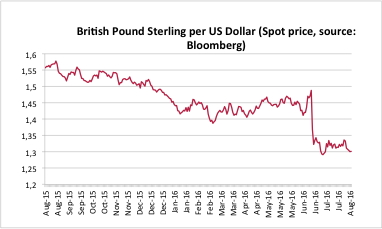

There have been few financial news. The Bank of England cut its benchmark interest rate by 0.25% as expected. The British Pound is heading to all-time lows – see also our chart of the day. Overall markets continued to calm down after the Brexit shock. There are no news from US Fed if they still want to increase rates by the end of the year. In combination with the quiet holiday time the major volatility indices have come down to record lows.

Erwin Lasshofer and his INNOVATIS team expect volatility to come back soon. We still see depressed yields in bond markets and limited potential for equity markets. For clients in our Managed Account we can generate attractive returns by topping-up existing notes or finding volatility in well-selected stocks.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login