Newsletter dated June 22, 2016

News has been completely dominated by upcoming Brexit poll. Tomorrow british voters will be asked whether or not they want to stay in European Union.

Currently analysts and investors put almost any market change in context of changing Brexit poll expectations.

See also our investment blog (www.innovatis-suisse.ch/investmentblog-on-upcoming-brexit-vote) explaining this topic.

So what is the current expectation for tomorrow’s Brexit vote?

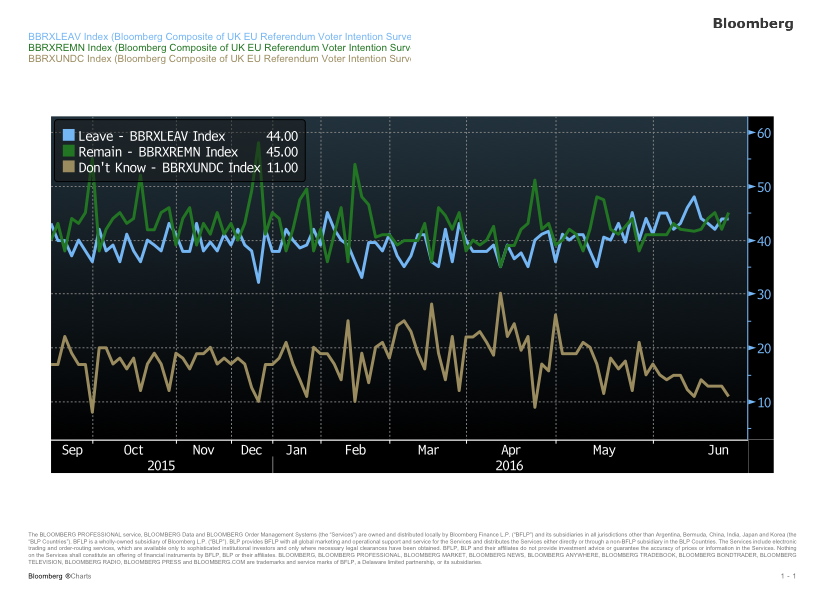

Latest polls see 44% leave, 45% remain and 11% voter that don’t know yet. See our chart of the day on this.

However if you ask investors and analysts such as Number Cruncher, Oddchecker, Bloomberg, Bing Predicts you get a probability of U.K. staying in the EU (Bremain) that is twice as high as leaving it (Brexit).

What can happen?

In case of a Bremain vote nothing much happens on the short run. Markets will get certainty of what they expected anyway and will slightly increase on the short run. On the long run we will wait for the next populist campaign to gain independence from the EU or break apart the United Kingdom or something else.

In case of a Brexit markets will be surprised to some degree and shift from risky assets to safe havens until the picture clear up. The most negative economic effect is expected to hit the U.K. The British Pound would decrease together with U.K. growth expectations and equity markets. Parts of the U.K. could decide to leave the U.K. and join the EU which would increase negative economic effects for the U.K.

For the EU it is not clear if a Brexit would have a negative or even positive economic effect. On the short run there can be negative effects from uncertainty. On the long run a EU without U.K. should be stronger in political and economic terms. Even or because it is smaller.

How will a Brexit work?

Actually this is just a poll on June 23rd. The U.K. government has promised to act accordingly. They could not withstand to use Brexit for campaigning during last elections. They promised run a poll and act accordingly although they do not want to leave the EU. The EU does not want the U.K. to leave either. In case of a Brexit both parties would have to negotiate terms of a departure although they do not want to.

How do we invest on this?

Erwin Lasshofer and his INNOVATIS team do not expect a Brexit to actually happen – even in case of a Brexit vote.

Our clients benefit from current uncertainty since increased volatility enhances our yields of structured products.

Check with us for our Managed Account to receive full investment service while keeping control of your own account.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login