Newsletter dated July 28, 2016

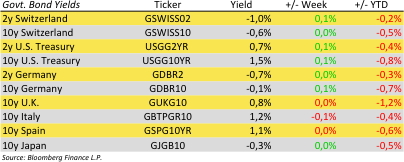

Versus our last report two weeks ago interest rate levels have decreased around the world and most major equity indices incased. Crude oil prices have pulled back significantly and gold has taken the lead of all asset classes with a gain of 25% as of year-to-date. See our chart of the day for the Gold Spot price per Troy Ounce in US dollar. We will take a closer look at Gold investments in our next investment blog. At the same time Emerging Markets have come back and taken the lead among equities.

Financial news around the world are still driven by the UK Brexit. The US Treasury research department OFR expects the Brexit could undercut US financial stability for years. The Bank of England sees negative rates ahead. Accordingly Royal Bank of Scotland warns customers of possible charges on deposits in UK. Italy based UniCredit prepares asset sales and 5 billion euros share offer blaming Brexit for increasing capital needs. Hedge Funds suffered from 20.7B outflow after a big performance drop of -5% last month.

Erwin Lasshofer and his INNOVATIS team take advantage of arising opportunities from this uncertainty. We can use increased volatility to create Core Expresse Notes and Multi Express Return Notes with higher coupons and increased credit spreads for more attractive Credit Linked Notes – see sample at „product of the day”. For full access to our investments instruments you may want to check for our Managed Account.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login