Newsletter dated August 25, 2016

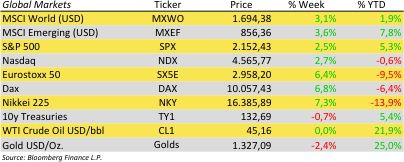

Risky asset classes continued to rally during the last two weeks. The biggest gainers are DAX, NASAQ and Emerging Markets in our list. On sector level we see materials and energy stocks as this year’s leaders. The biggest gainer among S&P500 sub indices is the S&P500 gold index which more than doubled versus year-to-date – see also our chart of the day!

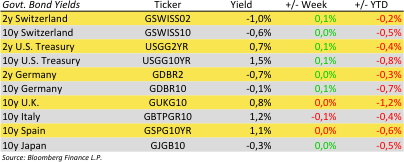

Interest rates of the Britisch Pound declined after the Bank of England (BoE) rate cut. While current official statistic on unemployment and inflation paint a rather robust economic picture most banks predict the UK heading into a recession due to the Brexit. While the BoE sees room for further interest rate cuts the US Fed sees economic targets nearly met – according to vice chairman Fischer. Markets price a probability of slightly over 50% for a rate increase by the end of the year.

A group of leading banks namely UBS, Deutsche Bank, Santander, BNY Mellon have announced to to develop a new form of digital cash that they believe will become an industry standard to clear and settle financial trades over block chain, the technology underpinning bitcoin. Having initially been skeptical about it because of worries over fraud, banks are now exploring how they can exploit the technology to speed up and free billions in tied capital. At the same time the BoE is trying to ramp up its research team for digital currencies which are experiencing growing attention in financial industry (see also our special edition click here).

Erwin Lasshofer and his INNOVATIS team continue to research industry trends and business models for selection of superior underlyings – see also our product of the day. However in case of block chain technology we still wait for companies that might be able to exploit this technology and are able to defend this advantage against competition.

|

|

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login