Weekly Newsletter #5/2015

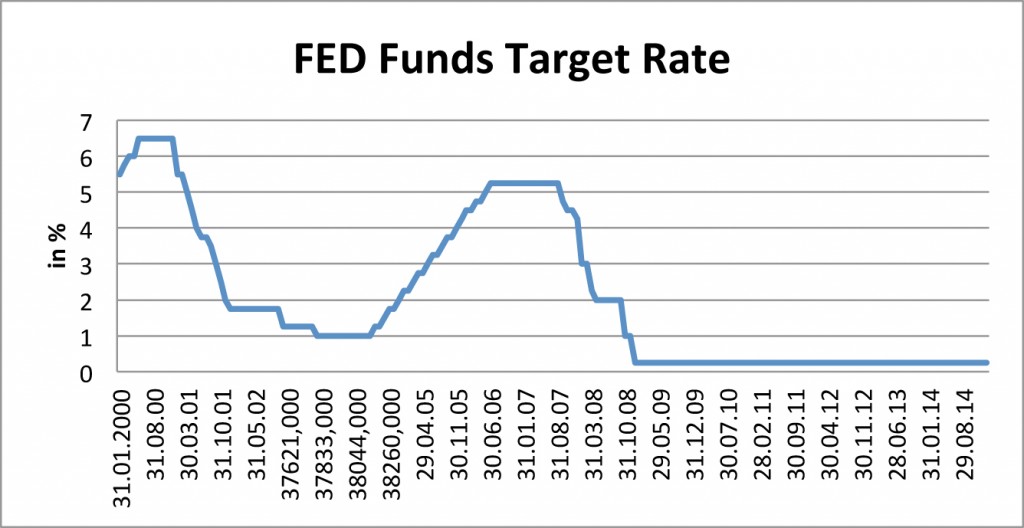

So what about rate hikes in the US now? When will the FED start to increase its rates for the first time since 2006? Well, people are expecting this to be very soon and the US Dollar already factors in higher rates for some part. But yesterday’s comments from the FED officials regarding those rate hikes show, that there are a lot of factors that are considered, especially on an international basis. Of course the data from the US economy are the most important ones, but you have to consider, that the US economy is strongly dependent from the situation in other parts of the world.

The job creation in the US was pretty good, but the strong US Dollar is everything else than good for exporting goods to other parts of the world. Furthermore the falling energy prices lower inflation, even if this effect could be a very short term phenomenon. To sum it up a lot of people are waiting for the rate hike(s) to come and it would be justified if the overall trend continues like this. But you always have to keep in mind, that there are a lot of factors that you have to consider and which have the ability to change the picture quite fast. So don’t take a rate hike in the next few months for granted.

Otherwise you could experience a big disappointment. Howard Marks from Oaktree made a good statement in his latest memo about oil, which also fits the rate discussion: „Asset prices are often set to allow for the risk people are aware of. It’s the ones they haven’t thought of that can knock the market for a loop.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login