Weekly Newsletter #4/2015

The financial markets consist for a bigger part of expectations, no matter if it are stock prices, interest rates, commodity prices or foreign exchange rates. And it is pretty hard to foresee expectations or the change of them respectively. The tricky thing is, that all of those expectation are somehow interconnected, so that it makes it even more difficult to have an expectation on the expectations.

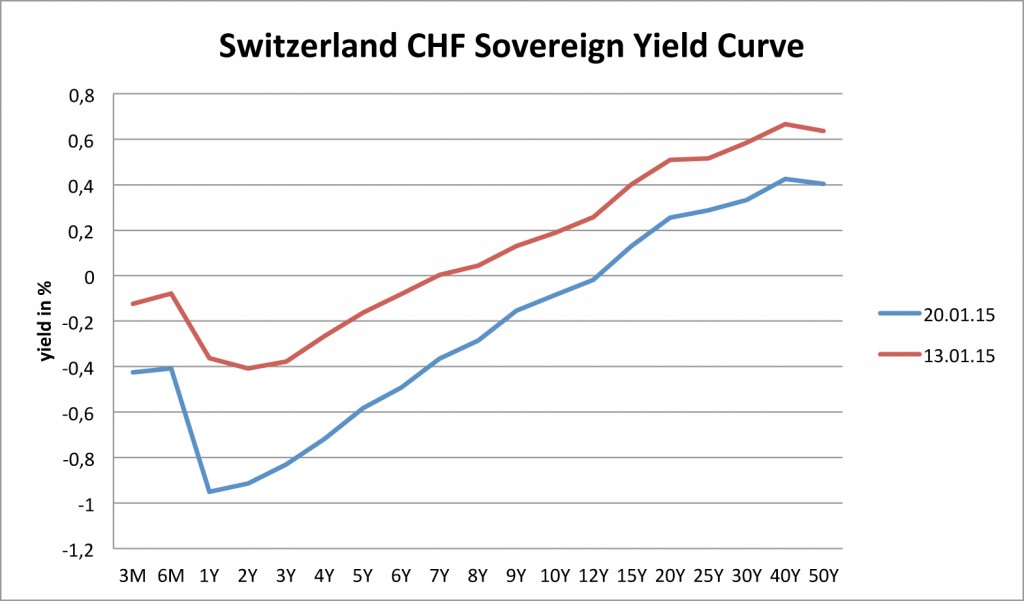

Last week a lot of expectations were crushed with the Swiss SNB giving up the defendance of the Swiss Francs minimum exchange rate to the Euro. This was more than just a surprise, it was a shock for the market and the reaction was accordingly. But it was a good example, that expectations are not for real, no matter how good they can be argumented or how clear the case is from a fundamental standpoint. So an investor always has to consider that there is a risk in regard of his investment (case) even if he thinks that there is no risk. This is even more important in an environment, where risk-free yield hardly does exist anymore and is constantly replaced by yield free risk. The USD seems to be the next scene with strong expectations and a relatively clear investment case.

The US economy shows a relatively strong picture and nearly everyone expects the FED to raise the benchmark rate from zero to 0.25% in one of its next meetings. Rising interest rates mean a stronger currency, what would support or explain the strength of the US-Dollar. But what would happen, if the FED takes more time than expected to raise the interest rates.

Bank of Canada recently surprised investors with a rate cut, a step nobody expected. If the current low in oil prices (also see an Interview with Mr. Lasshofer on our webpage http://www.innovatis-suisse.ch/out-of-energy/) shows its negative effects on the US economy and the growth does not look good enough for (further) interest rate increases, this could be really a big surprise from nowadays point of view. It is not said, that the US Dollar does not stay this strong for a while, especially as the market’s expectations regarding US interest rates have been relativised at the beginning of 2015. But overall that does neither mean, that the US Dollar is a safe haven for investors.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login