Weekly Newsletter

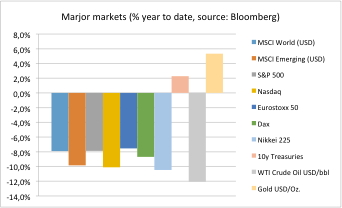

During the last two week major stock markets and crude oil reached new lows and recovered afterwards.

Earnings reporting season is painting a mixed picture. One-third of S&P 500 stocks have reported so far. Basic materials and energy stocks show dramatic sales and earning drops. However market expected even worse numbers which gives a positive surprise. Growth from healthcare, consumer services and telecom sector can offset most of the drops. Overall remains a sales decline of 1% and earnings decline of about 4%.

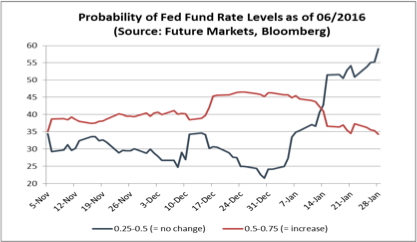

Main driver for markets remain the central banks. Last week the European Central Bank and Bank of Japan reaffirmed their efforts to provide markets with liquidity. The big question is U.S. Fed policy which entered the path of tightening last year. During recent weeks the probability for another U.S. Fed rate hike in March or June has dropped sharply. According to prices at U.S. Futures markets investors currently trade a probability of about 60% that Fed Fund rates remain unchanged by June 2016. This probability was below 25% at the beginning of the year! See also our chart of the day.

The key point is whether potential rate hikes will be cancelled or postponed. Currently U.S. Fed is cautious due to low global growth, financial risk from dropping commodity and energy prices. Also the strong US Dollar will depress consumer prices. Does all this matter? Yes, never fight the Fed!

Erwin Lasshofer and his INNOVATIS team expect the uncertainty of further rate hikes to persist by the end of the year. We do not see rates hikes in every quarter, but probably just one during this year. However the threat will keep weighing on markets and keep them volatile and sideways trending. We take this opportunity for creating attractive income driven products.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login