Weekly Newsletter

Erwin Lasshofer and his INNOVATIS team wish you a happy and prosperous 2016!

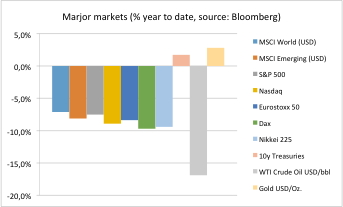

Almost any risky asset classes has been heading down during the first days of the year. Major stock markets have lost 5-10% so far. What has happened during the turn of the years?

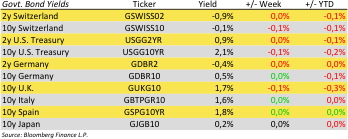

Little. It seems global markets are only now incorporating the US Fed rate hike we have seen just before Christmas. Most market participants had been prepared for this event by US Fed communication. Many analysts expect few and small further steps since there is no inflation and from the rest of the world rather weak economic data.

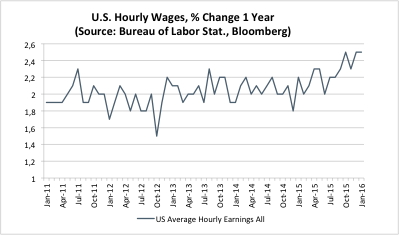

According to Fed’s Beige Book the absence of wage increases makes it difficult for the central bank to push up short-term interest rates further. This seems so be changing now – see also our chart of the day! The Bureau of Labor Statistics report for December see the annual change jumping to 2.5%. According to Bloomberg the analyst survey expects 2.7% for January.

Now more and more investors (and debtors!) around the world wonder if the rate hike in December was rather a big turn than a one-time event. Investors have to predict the yield level for the next couple of year to discount (uncertain) cash flows and to determine their risk appetite. The Fed has to forecast economic activity and financial liquidity in at least six months due to the time lag of their actions. This uncertainty causes volatility which had been rather unusually low during the last year than being extremely high right now.

Erwin Lasshofer and his INNOVATIS expect volatile markets trending sideways which is a favorable environment for issuing structured products.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login