Weekly Newsletter

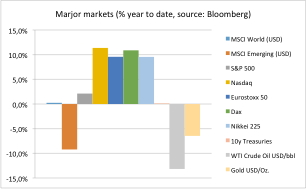

Market continued recovery. Nearly all risky assets gained during the last 2 weeks. As we expected the US Fed left interest rates unchanged.

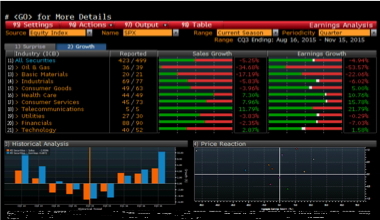

US Earnings reporting season is maturing. Overall sales dropped by 5% as expected and the 5% earnings drop was better than expected. See also our Chart of the day. The breakdown by sectors shows that basic materials and energy lost by as much as a third of revenue and half of earnings due to fallen global commodity prices. The remaining sectors are overall positive with double digit gains in Telecom, Healthcare and Consumer Services.

Erwin Lasshofer and his INNOVATIS team think the negative effect from the dramatic drop in energy and commodities will be offset by the overall robust US economy. In total average we do see a moderate growth in the US and no signs for a big change.

In some Emerging Markets the picture is quite different. Particularly energy or commodity exporters suffer from plunging national income. For example Saudi Arabia has posted budget surpluses averaging about 7 percent of GDP in the past 15 years. After recent crude oil price slump the International Monetary Fund predicts a fiscal gap exceeding 20 percent of economic output of the worldÕs largest oil producer this year. At that rate Saudi savings would run out after five years. Sharing oil wealth with the public has helped keep the Al Saud family securely in power as turmoil sweeps the region. We wonder if crude oil prices recover before destabilization of Saudi government or because of it.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login