Newsletter dated October 13, 2017

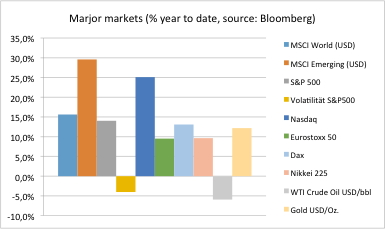

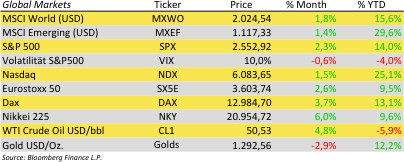

What has happened in the financial world? Despite the September is widely regarded as a difficult month in the financial calendar, mathematicians doubts in general that such seasonal observations provide statistical evidence. And when evaluating the results of September 2017 – or let’s consider the last 6 weeks since early September – they should feel confirmed by a broad range of financial positive markets. In fact many leading markets such as US stocks have marked new historic highs.

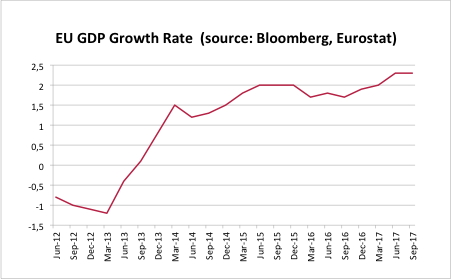

In particular European stocks have gained, not least because of good growth figures. The EU reported their last GDP growth at 2.3% p.a. which is not extraordinary much. See also our chart of the day! However considering its structural challenges both on top EU level and inside big core countries such as Spain, France and Italy this is considerable. Finally those countries have been struggling to get their unemployment rates below 10% since the financial crisis starting 10 years ago. And the EU growth rate is remarkable because it is nearly at the level of US growth which has not happened very often in recent years. Despite good economic EU growth rates the euro has slightly lost versus US dollar – for the first time since March of this year.

Some political events provided stability and others added uncertainty. While parliamentary elections in Germany lead to a loss for the established big parties there is still a good opportunity for building a democratic coalition under ruling chancellor Merkel. So are no economic disruptions to be expected from here anymore. On the other hand the British government is heading straight to an even bigger Brexit chaos or at least following quite a risky bargaining strategy. And it seems the Catalans (still Spanish) are trying hard to learn from British Brexit experts. Donald Trump has announced a big tax reform again. In most cases his announcements do not become true and most people are happy about it.

Overall Erwin Lasshofer and his INNOVATIS team expect financial markets to stay friendly. Inflation is low which will keep rates low for the near future both in the US and Europe. Average P/E ratios of about 20 equal an earnings yield of 5% which is still considerably higher than interest rates between 0 and 2%. We still find attractive opportunities that we utilize by tailoring structured products. The easiest access for our clients to benefit is our managed account.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login