Newsletter dated December 13, 2017

The investment year is heading straight to it’s end. In this newsletter we take the chance for a quick review and provide you with our outlook for 2018.

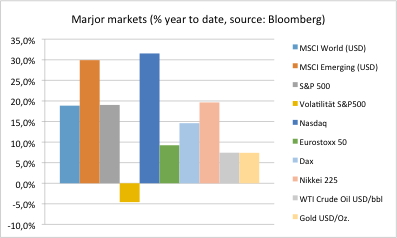

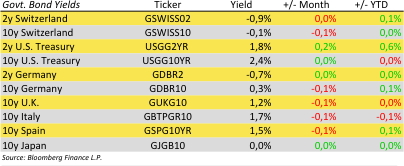

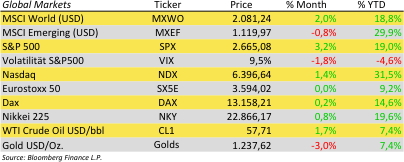

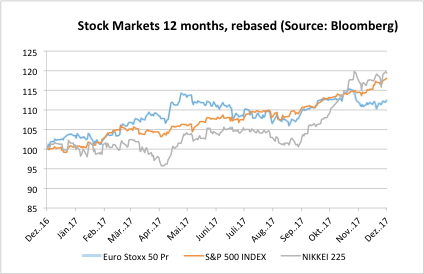

Despite the year is not over yet we take significant double digit gains for equity markets for sure yet. The winner will be high risk segments such as Emerging Markets or NASDAQ, followed by broad US and Japanese stock indices and with European stocks at the end. While risky assets gained above average the volatility has further come down.

Despite the turnaround of the US Fed Funds Rate many US equity markets marked all-time highs. President Trump raised many eyebrows many times by taking unorthodox decisions and making unsuitable statements affecting the US society or even threatening world peace. However, America looks still great. Japan has been on a good path of political continuity and economic breakup. Europe has made virtually no progress in working off its Brexit chaos. UK leaders still refuse to state any number for the divorce bill to be paid to the EU.

On the one hand France has elected a new a promising and ambitious President with a great potential for European leadership. On the other hand Germany has been struggling to from a new government after the recent parliamentary election. The revival for the Euro which can be attributed to a prospective turnaround in ECB monetary policy weighs on EU export activity and thus on European stocks. The fragile cartel of OPEC and mainly Russia has been successful in stabilizing the global crude oil price.

So where do we go from her in 2018? Erwin Lasshofer and his INNOVATIS team believe that markets will have a good start in 2018 before they might reach headwinds. First, the trend is positive and there is reason yet for a turnaround. Sentiment is positive, though not euphoric. The extreme rise of the Bitcoin can be considered a warning sign for a bubble. Yet this still seems to be a small niche and there is no wide spread exuberance to be seen yet. Valuations are high, however interest rates are low and we expect that global central bank will not overreact even if inflation came back. They have made great experience by pushing the pedal for decades and will not stop abruptly without being in serious need.

While low volatility makes investing in broad market investments increasingly difficult Erwin Lasshofer and his INNOVATIS team still find attractive opportunities for structured products in attractive niches. The easiest way for our clients to benefit from our investment picking is the managed account.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login