Weekly Newsletter dated October 6, 2016

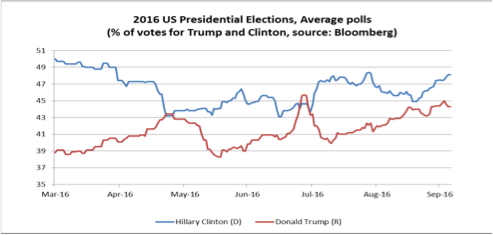

The US Presidential elections are just 1 month ahead of us. It’s far from clear wether Donald Trump or Hillary Clinton will be the winner. Investor wonder if they have to align their portfolios accordingly. They might have already heard such prophecies as “I would vote for Mr. Trump because he may only destroy the U.S. economy, but Hillary Clinton will destroy the whole world”.

In fact we know very litte about Trump’s economic agenda. This leaves many investors even more uncomfortable. On the other hand a potential presidency of Hillary Clinton is said to be bad for banks by imposing stricter regulation. Consumer discretionary stocks would benefit from lower taxes for middle-class incomes and increased minimum wages. She is promoting a $275 billion infrastructure plan and thus respective companies. While she would probably support healthcare service companies by expanding “Obamacare” she has been campaigning for lower drug prices which could depress pharma profits.

So how does US presidency really effect markets? And what should investors do about it? You can find out in our latest investment blog on Presidential Elections (http://www.innovatis-suisse.ch/news/ )

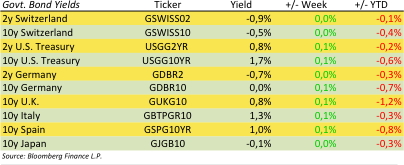

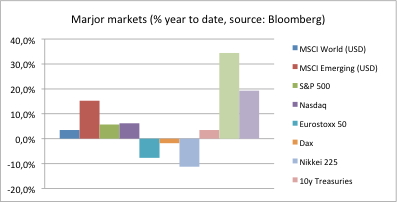

Versus our last newsletter two weeks ago equity and bond markets have little changed. The most significant moves were 12% up for crude oil and 7% down for gold. The jump in oil had been caused by an OPEC surprise. News headlines said they cut their output. In fact they agreed at a meeting in Algier to decide the group’s next formal meeting, on Nov. 30 in Vienna, on details of trimming production by up to 700,000 barrels a day which is less than 1% of world production. And it is still unclear how members share this cut. And OPEC’s overall share of world production has decreased to just on third over recent decades. However it is a surprising signal to markets of OPEC’s ability to strive for agreement and come over several rivalries e.g. between Iran and Saudi Arabia or OPEC and Russia.

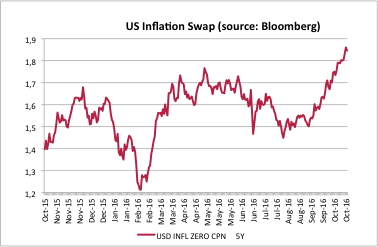

For the drop in Gold many analysts cite rate hike speculations. However, Erwin Lasshofer and his INNOVATIS see probability for a rate increase by the end of the year rather decreased – although still at a high level of over 60%.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login