Weekly Newsletter dated June 2, 2016

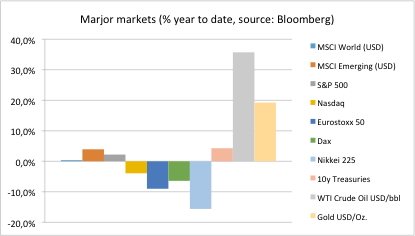

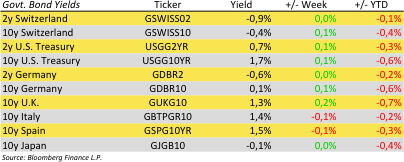

Currently there are no big news in the market. Investors are still waiting for the Brexit vote later this month (Brexit) and for the U.S. Fed (Marktes and interest rates Blog) which is waiting for the right moment to hike interest rates again.

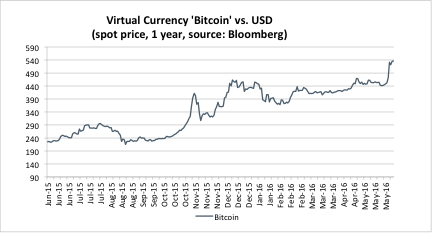

Bitcoin

While everybody is waiting we take this opportunity to take a closer look at Bitcoin. If you also believe this is just a temporary phenomenon for some computer nerds you might prove wrong. While there are some alternative digital currencies and Bitcoin has experienced some drawbacks it’s big, it’s coming and it is real.

See also our chart of the day.

Fortunately in Wikipedia a definition of Bitcoin is in simple English available: ‘Bitcoin is a digital and global money system (currency). It allows people to send or receive money across the internet, even to someone they don’t know or don’t trust. Money can be exchanged without being linked to a real identity. The mathematical field of cryptography is the basis for Bitcoin’s security.‘ See more details there on how it works.

Since Bitcoin is decentralized and anonymous it is very hard to control. It takes no central bank or similar institution. While some doubtful people might abuse anonymity it’s experiencing fast growing popularity far beyond this group. There are already more than 100’000 merchants accepting Bitcoin for products and services!

How does it effect investment business?

This could do not less than changing the whole financial system. Just think of current power of central banks that might become obsolete. Bitcoin has been introducing a whole new technology how to secure and distribute data: blockchain. Every user is allowed to connect to the network, send new transactions to it, verify transactions, and create new blocks which makes it permissionless.

According to a State Street research 74 percent of asset owners say they believe blockchain will achieve the scale needed for adoption. While a majority of asset owners and asset managers expect it to be widely adopted in the investment industry in the next five years, only seven percent currently have initiatives underway to support it.

Bitcoin Exchange

There is an unlimited number of exchanges like Coinbase or Kraken to buy virtual currencies such as Bitcoin. There is an increasing number of merchants selling real goods for Bitcoins. And there is even an exchange trading investment derivatives. BitMEX has been founded in 2013. So far, 5,800 users have traded $760 million on the exchange. The company is already profitable and expanding rapidly. Currently it has 90% of its customers in China who benefit from an access to global markets and leverage by financial derivatives offered on BitMEX. While BitMEX accepts payments in virtual currencies the investment derivatives still have a classic design like at the Chicago Mercantile Exchange.

Outlook

Erwin Lasshofer and his INNOVATIS team see a huge potential for a technological and financial revolution here. It is certainly big enough to be taken very seriously. It will change the way we pay and thus the financial sector. For the next few years we see no direct effect on the way we design structured products. However, we will watch this development closely and select underlyings accordingly.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login