Weekly Newsletter #9/2015

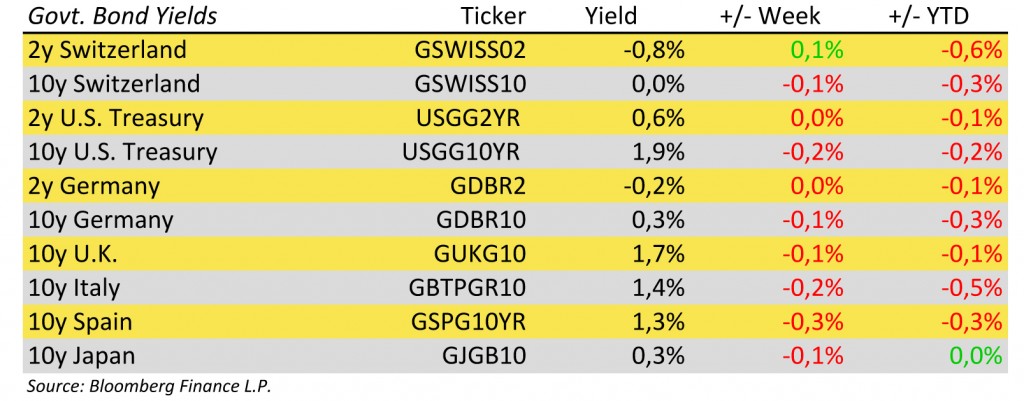

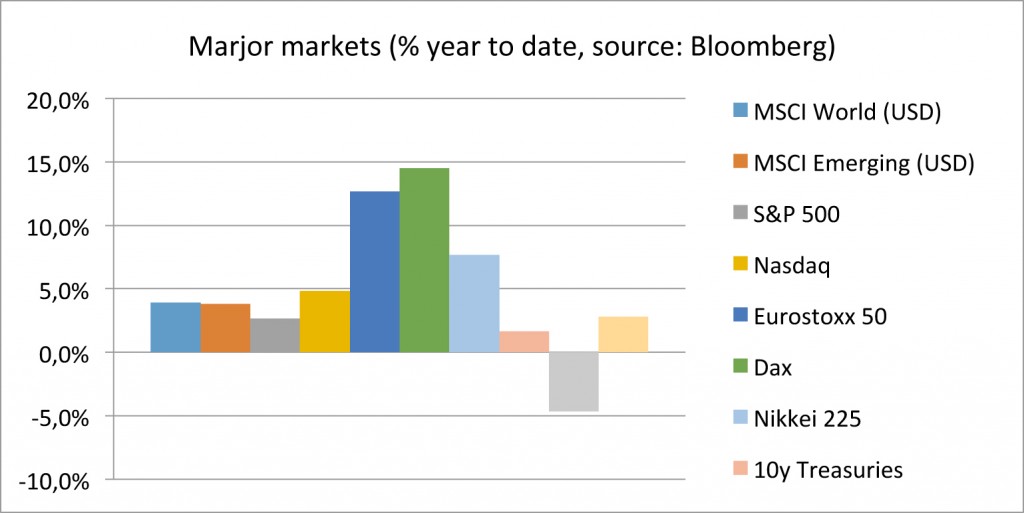

Please, kindly note that we have updated our data sheet. We see much more dramatic market development in interest rates, crude oil and maybe sooner or later in gold than in equity sector rotation.

We see interest rates all over the world falling to zero. And this is a big game changer. We do not talk about real or net returns (after inflation, after taxes) anymore. We are looking for any yield at all.

Is this just a temporary phenomenon? When we did not agree with speculations about 2015 Fed rate hikes in the third quarter of last year we did not even see the drop in crude oil and the strong US dollar yet. So, no we don’t see a change without strong global economic growth.

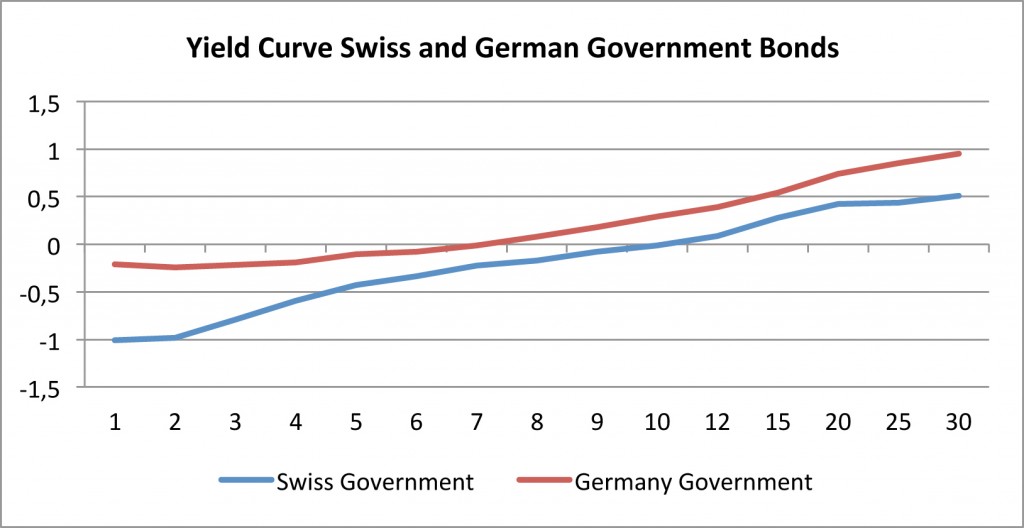

And even worse: negative yields. For the short term up to 6-9 years in CHF or top rated EUR government bonds yields already are negative. See our chart of the day! What will the Swiss pension fund manager do now when managing liquidity? Will he buy the “risk-free” loss? He might be in violation of rules and laws if he does not!

And what about the investor who is responsible for himself only? He can buy bonds that are too expensive just for the hope to get even more expensive. This is the classic price bubble scenario. He can buy equities. Are they expensive after the recent gains? No yields for the risk-free asset drives most valuations for risky asset classes to infinity. We will take a closer look in our next newsletters at valuations of common asset classes.

What do we offer if you are insecure about future market moves and you are looking for yield? You should consider a structured product that gives you a reasonable yield at a very limited and well controlled risk – see our offer below.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login