Weekly Newsletter #48/2014

It has been just a few weeks since the equity markets tumbled for 8% and more within less than a month. A lot of market participants were feared to see the beginning of the hausses’ end, having missed the opportunity to sell into the last breaths of the liquidity bubble. But from mid October on the markets started to rise again – mostly faster than they fell before. And so we have for example surpassed the old highs of the S&P 500 already, approaching 2100 points in the leading US equity index.

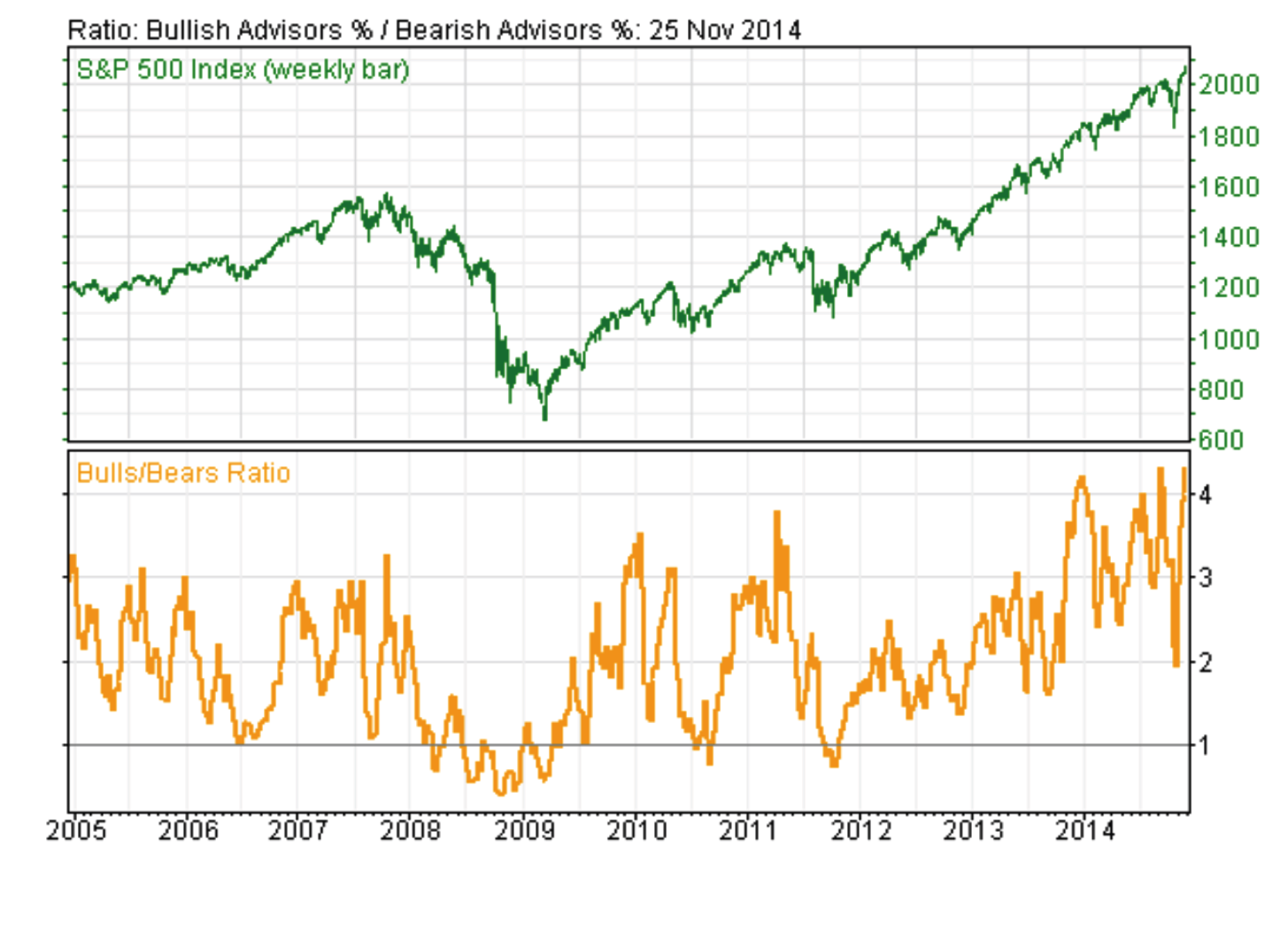

What was or is respectively even more remarkable is the sentiment and how it changed. And is not the massive fall of the sentiment in the course of the markets correction, but the rapid rise afterwards. Maybe it is the lack of investment alternatives or the believe in the blessing and the endless offer of cheap liquidity. But Bulls already outnumber Bears with more than 4:1 again, leaving the sentiment at an absolute all time high.

Based on investors sentiment market participants have never been so optimistic on stocks than nowadays. We don’t know, what makes them so bullish nowadays, but we know, that extremely high sentiments are more a sign of danger than they were a harbinger of stable markets in the past.

Capital Guaranteed Solutions

In an environment of low yields and high equity markets many investors are looking for capital guaranteed products which are able to generate real yields despite the difficult situation. INNOVATIS (CEO Erwin Lasshofer) offers its client a constant flow of market ideas and products that are made for producing an optimized payout profile in regards to market situation and clients needs. Therefore we also intensified our development in regards to capital guaranteed solutions in the last few weeks and would like to show to you some of those products. If you are interested and would like to receive more information on those capital guaranteed products don’t hesitate to contact us on fp@innovatis-suisse.com or simply call us on +41 44 215 306 0.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login