Weekly Newsletter

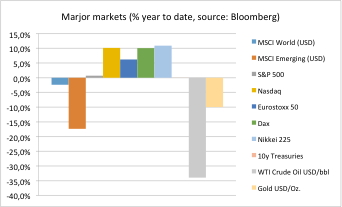

The year is almost over. The MSCI World is nearly unchanged as well as global government bonds. The losers are Emerging markets and commodities, in particular metals and energy.

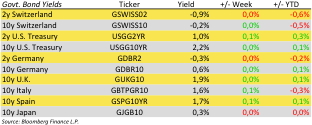

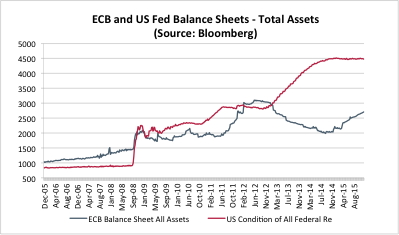

Yesterday the US Fed increased its Fed Fund target rate by 0.25%. This step had been announced for 2015 and delayed to the very last Fed meeting of the year. Despite being bad news for most asset classes markets appear to be happy that the waiting is over now.

Also beside the Fed waiting game 2015 has been an exciting year. There have been VW Diesel gate, big changes in China, another Greek shake up of Eurozone, hundreds of thousands of refugees caused by in increasing mess in Middle East, Russian adventures in Syria and Ukraine, to name just a few.

Where do markets go in 2016 from here?

Erwin Lasshofer and his INNOVATIS expect volatile markets trending sideways. Economic and monetary growth is limited. While the US Fed is slowing down the ECB is still expanding. We expect increasing M&A activity in commodities and energy sector that will finally lead to increasing prices. For a recovery of crude oil prices an agreement between OPEC and non-OPEC producers will be essential.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login