The Trend – A Friend or just an Enemy

The trend is your friend….that’s maybe one of the most quoted sayings in the financial markets. And basically it’s right, as long as you are riding the trend in the right direction and are (hopefully) able to exit your position before it ends. Anyway, you should neither rely on a trend, nor should you rely on a trend ending, just because an asset class is already overly expensive or overly cheap. Just take a look at the development of the equity and bond markets in the last few decades and you will get an idea, what could be meant.

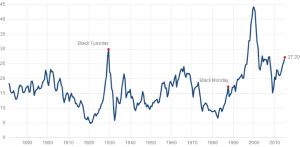

Regarding the equity markets phases of overvaluation seem to be really obvious – in hindsight. Just take a look at a thought out valuation ratio and you’ll clearly see the mistakes investors made in the past. Let’s take the well-known Shiller P/E for example.

Source: multpl.com/shiller-pe

The Shiller P/E simply takes the rolling average of inflation adjusted earnings from the previous 10 years, also known as the CAPE-Ratio. As the Shiller P/E factors in the earnings of the last 10 year it is much less sensible to wild swings in earnings.

So if we take the Shiller P/E and take a look at the valuation levels at the end of the last century for example you definitely will think that markets were pretty expensive then. Today we know that the market at the end of the 90’s was strongly based on a lot of fantasy and very low quality perspectives. Despite the high valuation and the low substance, investors kept on buying, riding the trend and becoming even more euphoric the higher the levels of the markets rose. We all know how this ended: markets were losing nearly half of its value, not only erasing a lot of money but also causing a recession in the US. A lot of people called it the end of equity investing but the coming years proofed them to be totally wrong. The US market climbed higher than ever before, even if he needed nearly seven years to reach the old highs. A lot of people were making a lot of money…but not only on the equity market. The central bank’s strategy of cheaper money and various inventions in the financial markets led to a real estate based financial bubble never seen before. So even if the story was different, there were a lot of parallels to the bubble a few years before. High valuations and something excessive, which had no relation to the real economy anymore.

Source: Bloomberg

But why were people investing, even if they knew, that markets were not cheap anymore. What was their reason to buy high valuations? Well, the answer is pretty simple, it was the trend. Cause the trend is a phenomenon based in the herd behavior. People realize that many investors out there earn a lot of money with their investments. So they simply tend to mimic the action of this larger, successful group, no matter if rational or irrational. I remember that there was a computer game in the 90’s called „Lemmings“. And I still remember how much fun we had with this game, even if I always thought how stupid those little creatures in the computer game were. To be honest, you’ll find a lot of those lemmings in the investment community out there.

But you’d better not believe that those trend riders out there are all private investors. A lot of them are professionals investing money for their clients. The reason for professionals following trends is not always the „lemming-phenomenon“. Very often it is a certain kind of risk, the so called career risk. Could you imagine what the client expects from an asset manager if the equity market makes 10% – 20% every year, no matter where the valuations are, and everybody talks about how great equities are? Right, he’ll expect his asset manager to invest a huge portion of the money into equities. If he strongly underweights equities and is not lucky enough to have found another asset that made up for those opportunity cost, the asset manager will have a pretty hard time in his job.

So the trend is by far not always your friend. You’ll have to decide by yourself and in a rational way if an investment makes sense at a certain point in time. Always keep in mind, that there is no free lunch out there and every investment has a certain risk…even holding only cash has a certain risk, besides the fact that you will definitely have real losses nowadays because of inflation. Nevertheless, keep on analyzing the facts and make your homework to get a reasonable risk-return-ratio. And if everybody – including your grandmother and the taxi driver- is crying to buy a certain investment or market, better think twice or thrice about it. You know, the lemmings are out there!

If you take a look at today’s markets, you will definitely realize having a lot of those trends out there, which could attract you to invest. The equity market is one of them. The performance of the equity markets has been impressive in the last few years and you are for sure a lucky devil if your money made the whole upside move since 2009. You will definitely find a lot of voices out there with a lot of good arguments, saying that the equity market is still extremely attractive to invest, even based on its valuation. But I promise, if today would be the end of the 90’s or mid-2007, you would have found at least as many positive comments on the market.

I don’t say that I know where the market will go. I only say, that from a rational, absolute and relative standpoint the markets valuation is quite high. Maybe I am wrong and markets heading to an even higher valuation with the S&P reaching 2500 or more within the next two years. But always keep in mind, that the markets’ level currently seems neither based on its’ fundamentals nor on the economy’s development. It seems to be based for a bigger part on the artificially low interest rate environment and the massive liquidity available – I know that all of the central banks activities are targeted to boost the economy, but hey, the market already has factored this in. So, maybe you see the parallels?!

Nevertheless the stock market still offers attractive opportunities, but maybe not on a plain vanilla basis. For us it is more to give the investors kind of a protection in regard of its equity investment and earn a certain yield by using the stock market as an underlying. That is how we would tackle the market at the moment, just because timing is really dangerous nowadays – in both directions.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login