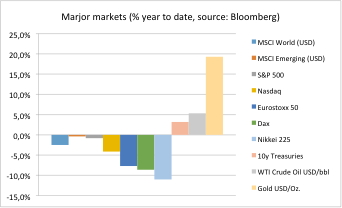

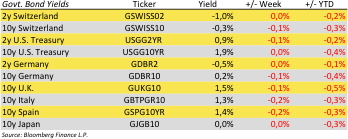

Newsletter dated March 17, 2016

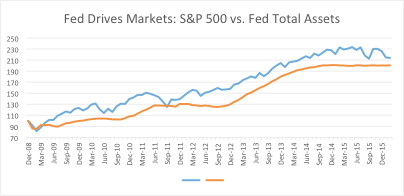

Central banks drive markets. See our chart of the day for an obvious link between Fed bond buying activity and US stock market.

Last week ECB president Mario Draghi caused some confusion when announcing latest monetary stimulus. This is even more remarkable since he actually delivered the expected rate cut and extension of the ECB bond buying program.

First markets celebrated Draghi’s “Big Bazooka” since he played virtually all instruments available to him and some of them louder than anticipated. Equity markets jumped by 2 percent. However right after he said, that interest rates would probable stay at the current low levels for the next few years the party was over. This means no further interest rate cuts. Markets dropped by about 4 percent. The day after investor overcame their hangover and paired losses.

Yesterday the US Fed did not increase – as widely expected. Now the official wording has been reduced to ‘2 steps during 2016’. Currently the market sees a higher probability of an increase by just 0.25% which means 1 step.

Erwin Lasshofer and his INNOVATIS team think that central banks play significant role for global markets. See also our investment blog on this topic that we issue last week.

The US Fed is still tightening liquidity however at a lower pace. Other central banks around the world are expanding. If these contrary developments continue we will get more volatility at currency markets.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login