Investment Blog Emerging Markets

Emerging markets used to outperform developed markets in both doom and boom periods. Enthusiastic analysts formed new economic investment classes such as „BRIC“ countries that would own the future. Since the Financial Crisis nearly 10 years ago the party seems to be over. Is it in fact?

What are Emerging Markets?

Emerging markets are countries with rapidly growing economies but are generally “less developed” than the largest nations in the world such as the United States and those of western Europe. Some of the largest countries considered to be emerging markets include China, India, Russia, Brazil and Mexico.

In general, the market risk is higher for emerging markets than that of more developed countries. The reason for this risk is usually due to political risk or unrest, questionable accounting standards or unstable currencies. However, the higher relative risk is thought to provide higher potential returns.

Still growing Importance

The long-term global economic power shift away from the established advanced economies is set to continue over the period to 2050, as emerging market countries continue to boost their share of world GDP in the long run despite recent mixed performance in some of these economies. China has already overtaken the US to be largest economy. By 2050 India could overtake the US going into 2nd place and Indonesia could move into 4th place by 2050, overtaking advanced economies like Japan and Germany. China and India alone make up 40% of global human workforce which will gradually increase global share of GDP and market value over time.

Key Characteristics

Emerging markets have five key characteristics.

First, they have a lower-than-average per capita income. The World Bank defines developing countries as those with either low or lower middle per capita income of less than $4,035.

Low income is the first important criteria because this provides incentive and basis for the second characteristic: rapid growth. The low initial level of economic development provides more opportunities for catch-up with higher income countries by making use of their technologies and ideas resulting in above-average growth rates.

Rapid social change leads to the third characteristics, high volatility. That can come from three factors: natural disasters, external price shocks, and domestic political instability. Emerging markets are more susceptible to volatile currency swings, such as the dollar, and commodities, such as oil or food. That’s because they don’t have enough power to influence these movements.

Rapid growth requires a lot of investment capital. But the capital markets are less mature in these countries than the developed markets. That’s the fourth characteristic. They simply don’t have a solid track record of foreign direct investment.

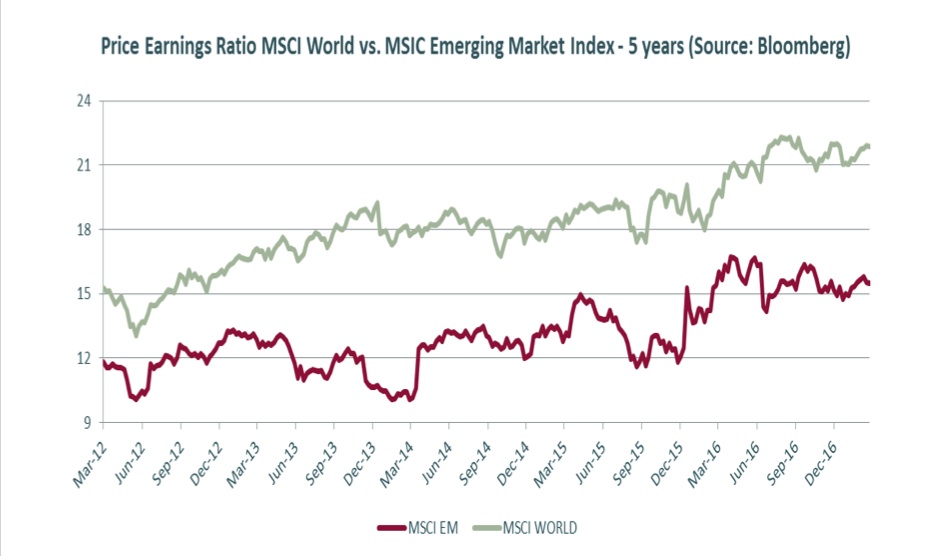

Growth and volatility lead to the fifth characteristics, higher-than-average (expected and required) return for investors. Thus emerging market assets often combine both higher growth and lower valuations. See also comparison of price/earnings ratio for MSCI World and MSCI Emerging Markets below.

Performance

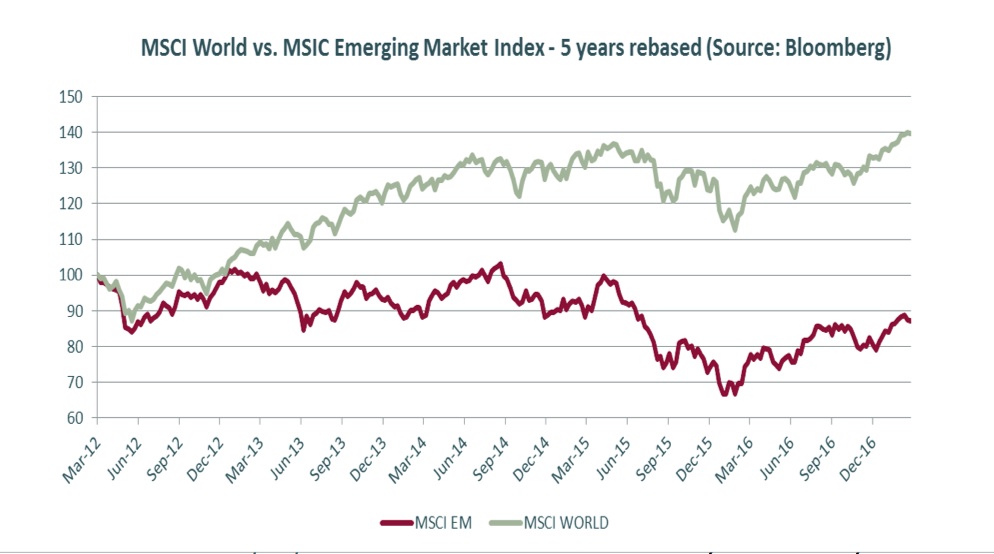

Last year emerging markets slightly outperformed developed economies thanks to improving fundamentals and low interest rates. While the MSCI Emerging Market Index increased by +8.6% the MSCI World climbed just +5.3% in 2016. However, for the full 5-year term ending February 2017 a -0.2% emerging markets result compares to +61.6% (total return including dividends) for developed countries covered by the MSCI World. See current price chart below!

Challenges and Opportunities

The Federal Reserve’s interest rates hikes could take a toll. Many emerging market companies have benefited from low U.S. interest rates by borrowing in dollars and repaying debt with stronger local currencies. Higher U.S. interest rates implicate a stronger U.S. dollar both making these debts more difficult to service. These increased costs could lead to a wave of corporate defaults that would hurt the emerging market economy. The government balance sheet is often facing the same issues for its foreign borrowings. For example, South Africa borrowed heavily when the dollar was low and used the proceeds to help finance its growth and budgetary needs. Now it is facing lower credit rating and higher borrowing costs resulting in sovereign rating pressure making it difficult to obtain the funding needed to invest in growth.

Furthermore foreign investments will fall. With U.S. and European bond yields at record lows, investors have been attracted by higher yielding emerging market stocks and bonds to bolster their portfolios yields. Higher interest rates could draw more investors back to the U.S. and spark an outflow of capital from emerging markets. This lower foreign investment could slow down economic growth in many economies that rely on such investments. The so-called Fragile Five economies have been deemed the most vulnerable to this kind of downturn – Turkey, Brazil, India, South Africa, and Indonesia.

On the opportunity side there is a steadier Chinese growth. The fortunes of China’s economy are key to the overall emerging-market performance. With an $11 trillion GDP, China is roughly equal in size to the next 10 largest emerging markets combined. The government stimulus is stabilizing activity. And rising consumer spending is partly offsetting weakness in the „old economy“ industrial sector. At the same time commodity price have been stabilizing which supports economic growth and profits in commodity-exporting emerging markets, especially in Latin America.

The characteristic growth advantage is likely to return in the coming years after the economies of Brazil and Russia stabilize after deep recessions. Accordingly earnings per share, which have fallen by around one-third since early 2012, have started to stabilize. While valuations are now close to the average for the past decade there is room for further price appreciation if profits improve.

Summary and Outlook

Erwin Lasshofer and his INNOVATIS team still believe investment opportunities in emerging markets will outperform developed markets in the long run. John Maynard Keynes would certainly reply „in the long run we are all dead!“ So right now we see moderate valuations, recovering economic growth and recovering earnings. However increasing U.S. interest rates and accordingly the stronger U.S. dollar can be challenging to some countries and companies, particularly if relying heavily on foreign financing and direct foreign investments. Thus it is important to pick carefully. We invest very selectively, in particular in emerging markets. The most convenient way for our clients to enjoy this service is a managed account with full service from INNOVATIS while keeping full control for the client.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login