Weekly Newsletter

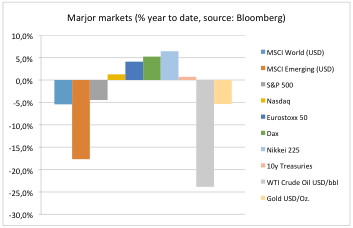

During recents days markets dropped dramatically. It was the biggest decline since the 2008 financial crisis. Just during U.S. trading session on Monday the Dow Jones Industrial lost as much as 7% vs. the last closing before partly rebounding.

In the absence of material fundamental news there was blind panic in the market. Concerns on Chinese and general emerging markets growth have spread. Slower economic growth in China has been blamed for the decline in sales of passenger vehicles. Shrinking export numbers worsened the big picture. But the devaluation of the Yuan caused markets around the world to fall.

China’s GDP is forecast to grow 6.9% this year, the slowest pace in a quarter century. Global GDP growth is about 3%. Despite questionable accuracy of Chinese statistic data there is no doubt that China has been the main contributor to global growth.

The combination of diminishing growth rate with large amounts stocks investments based on debt margins have caused the market to crash. Chinese mainland stock indices lost about half from their highs three moths ago. The strict separation from mainland and Hong Kong investor is a Chines phenomenon. Arbitrage is not working and thus both groups pay different prices for the same asset.

See our chart of the day for premium that mainland investors (A shares) pay versus Hong Kong investors (H shares) of exactly the same stock!

We think China will continue to drive markets in the future. That’s why we will take a close look and publish a blog on our homepage soon.

On the upside there were some good economic news from the Western world. German business confidence unexpectedly increased in August. U.S. GDP growth has been reported above expectations. While the latter used to be bad news because of fears the U.S. Fed could raise interest rates. Analysts see 50 percent chance of rate hikes by December this year.

Erwin Lasshofer and his INNOVATIS team think there is no economic reason for rate hikes. Growth is sound, inflation is below target, the U.S. dollar is (too) strong. Slowing and devaluing Emerging markets will curb global inflation further. Higher U.S. rates and dollar would drag money from there. Particularly energy and commodity exporters suffering from low prices could get into serious trouble then. The only reason for rate hikes is that they have been announced earlier this year.

So there is a lot of uncertainty in the market again. This offers great opportunities and thus higher yields for many structured products. We take advantage of this for the portfolios of our clients.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login