Weekly Newsletter dated November 3, 2016

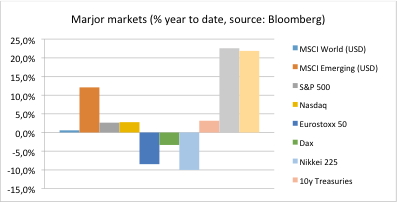

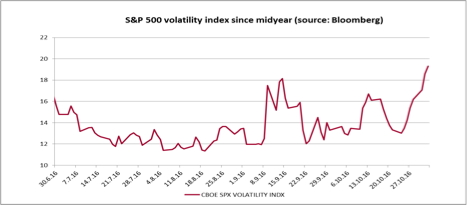

After an unusual quiet period the volatility has been returning to financial markets. See our chart of the day. At no surprise some of the biggest gainers of this year have seen the largest downside – e.g. NASDAQ, Emerging Market stocks or Crude Oil.

Erwin Lasshofer and his INNOVATIS team see merely a technical reaction than fundamental news driving this move. There have been some headlines regarding the Brexit (see also our invest blog!) According to a recent signal from UK Supreme Court the government must not trigger the EU departure without parliamentary approval. While Prime Minister Theresa May has pledged to obey the referendum (“Brexit means Brexit”) there are many pro-EU members that are expected to postpone or even prevent the Brexit process. The potential delay gives both the UK and the EU more time to prepare for the potential change. France created a one-stop shop to welcome businesses from Britain who are looking to set up new European headquarters as the U.K. prepares to leave the European Union.

On the other side of the Atlantic US elections have been shaken up by surprising announcements of the (Republican) FBI director James Comey. The announcement narrowed the gap of Donald Trump to Hillary Clinton and triggered some interesting market movements: precious metal were up and Latin American stocks and currencies dropped. However, Erwin Lasshofer and his INNOVATIS team prefer not to overvalue the influence of the US president on US economy. See also our special (US presidential elections)

While we explore opportunities on the level of single underlyings we welcome the increased overall market volatility since it further increases our diversified investment universe.

|

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login