Weekly Newsletter #8/2015

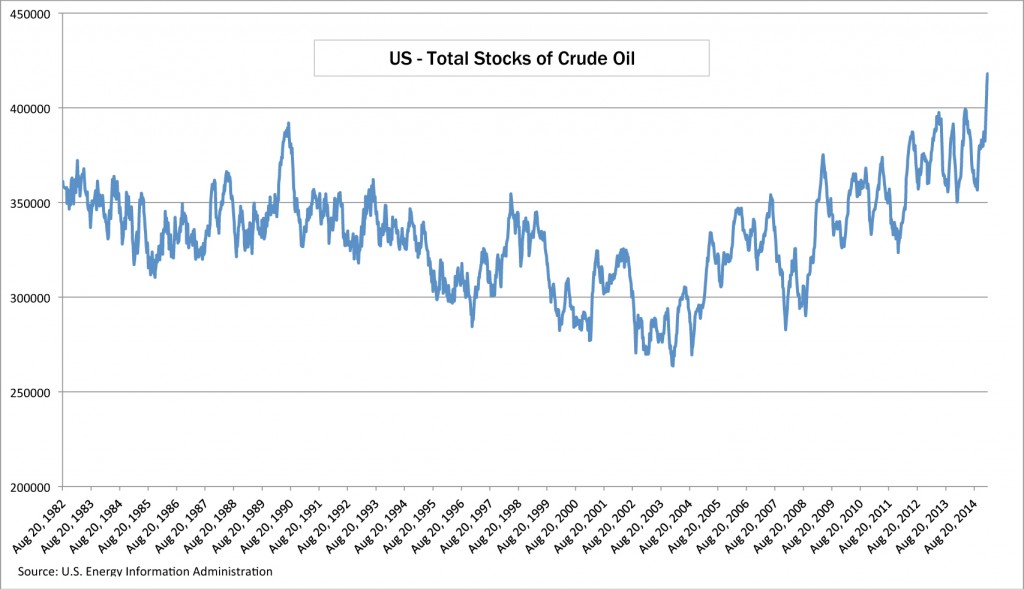

There are a lot of important topics out there that investors have to deal with at the moment. And all of them could influence the markets quite heavily. Whereas the situation around Greece seems to calm down a bit, the Ukraine is still „on fire“. In the US the expected rate increases seem a bit more improbable since yesterday, as the minutes of the last Fed meeting showed, that officials tend to hold the interest rates near zero for a longer time. And even if the recordings show that the reasoning is mainly based on the situation outside of the US, the US economy looks more fragile than most of the people out there are thinking. There are a lot of signs, that growth in the US is not as good, as the FED is signaling. This makes interest rate increases even more implausible. And last but not least we have the oil price, which is maybe one of the most discussed topics out there. Countless expectations where the oil price will head are published every day and it will be the same game as always. Time will proof most of them to be totally wrong. Nobody seriously can tell where the oil price will be at a certain point in time. Even if someone will be right on his projection, this will be pure coincidence. It is the same with all asset prices. The Financial markets are much too complex to project prices for a certain point in time. You can tell, if prices are cheap or not by doing your homework and apply sophisticated valuation methods in combination with proper research and common sense. But never try to predict if a price will go up or down in short term. Better try to invest, not to speculate.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login