Weekly Newsletter

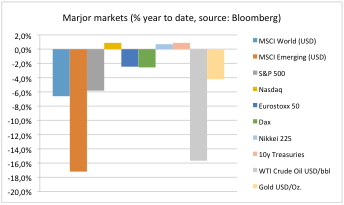

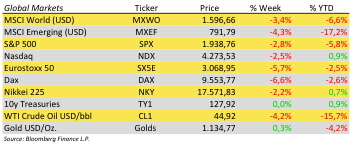

Last week the U.S. Fed remained interest rates unchanged. Although markets used to celebrate such events at former Fed meetings this time was different. Fed cited both strong US dollar and weak global economy which raised investor concerns and caused markets to drop instead.

Currently investors sentiment is bad. On the one hand the market is afraid of global recession lead by China sending equities and high yields lower. On the other hand any positive economic data cause investors to fear US interest rate hikes sending risky asset lower as well.

Last weekend Volkswagen said it faked pollution controls. The scandal has been widening to at least 11 million cars worldwide. Standard & Poor’s placed its A rating on VW on CreditWatch negative. This incident could also indicate a wider industry problem, if other manufacturers have followed similar practices, and it may lead to tougher industry-wide regulations and requirements for diesel engines.

Current high volatility and low prices provide great opportunities in structured products on car makers. However conditions change from day to day. Please check back with us if you are interested.

So where do markets go from here? Erwin Lasshofer and his INNOVATIS team expect a slowdown in China which can be stabilized though. See also the China analysis of our last newsletter. The ECB will continue quantitative easing. We do not expect any inflation or accelerating economy in the US. So there is still no need for rate hikes. And if there are any they will be very limited and just to save face after announcing them.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login