Weekly Newsletter #10/2015

In our last newsletter you read about the challenges that investors looking for yield are facing these days. Since major government yields have fallen to nearly zero or even below we suggested to invest in very conservative equity-linked structured products as fixed-income substitute. And what about more dynamic equity linked products such as the Lock-In product below? Well, many investors argue that equity markets have become too expensive after recent big gains – particularly U.S. equities. Is this true?

The answer is – guess what? – not easy. Let’s take the S&P500 index which covers the 500 largest U.S. companies. It gained 78% during the last 10 years or about 8% p.a. Is it expensive now? Most valuation models discount future cash flow by a factor that is composed of risk free yield plus risk premium. This factor is very sensitive to marginal changes and opinions in a fair risk premium vary widely among economists. However, historically low yields are a matter of fact. Thus historic valuations – e.g. P/E of 10 is fair and P/E of 20 is expensive – cannot work.

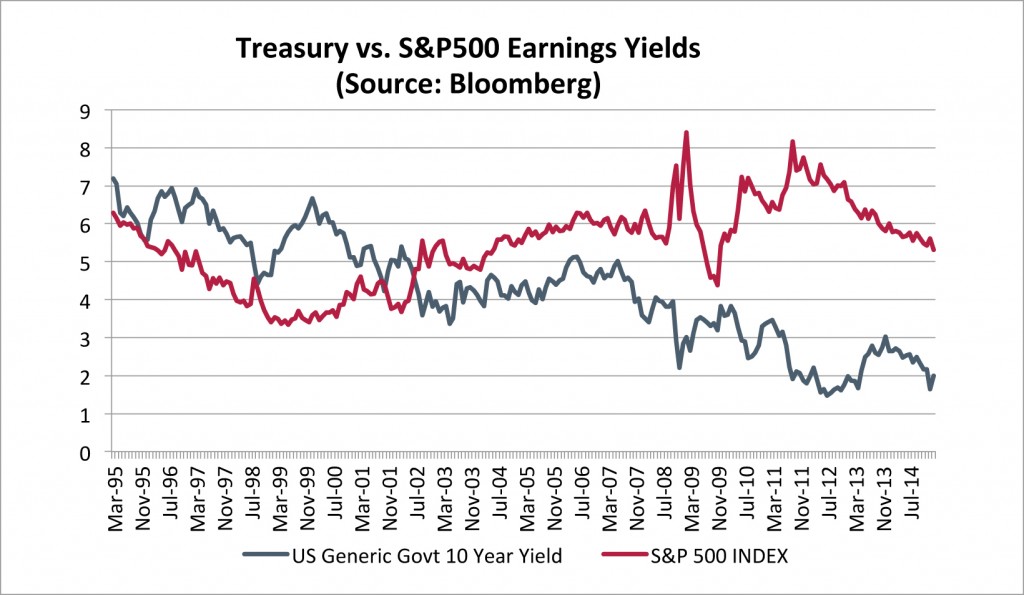

Let’s take a closer look how yields have changes. 10-year US Treasury yields have come down from about 7% to recently 2.0% – see chart of the day below. The earnings yields (= 1 / PE ratio) of S&P500 varied between 4% and 9%, recently yielding 5.3%. If you consider the continuous fall of treasury yield you would expect earnings yields to fall too. Otherwise risk premiums must have risen or equity markets got cheaper versus 10 or even 20 years before! Now you can decide yourself if the world has become more dangerous or equity markets cheaper! In Erwin Lasshofer’s opinion equities are still far from (too) expensive.

| Chart of the Day |

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login