Newsletter dated February 12, 2016

Equity markets extended their losses and are close to panic mode.

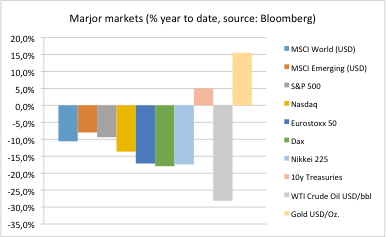

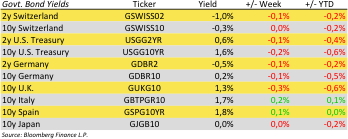

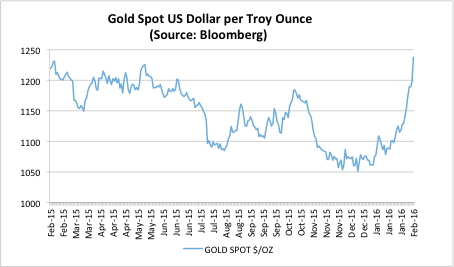

Crude oil is testing new lows again which means a loss of 28% year-to-date. Leading equity indices are 10-20% down. Treasuries and Bund are up. Investor are heading back to gold which is 15% up. See our chart of the day!

That was the simple part of our bi-weekly newsletter. The big question every investor is asking now is where do we go from here? Let’s check how we got here first. We have a mixed earning season. Investors dump stocks on bad news and even more on bad outlooks. US Fed is still signaling further interest rate hikes for this year which investors do not believe in. European and Japanese central banks announce interest rates cuts which investors do not care a lot about. The worst market concern is that of a recession while monetary actions by central banks prove being ineffective.

So are we heading to a recession? Some early indicators such as industrial orders or commodity prices say yes. Robust economic data from leading economies such as US or German unemployment rates say no. Goldman Sachs says no. JPMorgan as well. If you believe in this or not – they see the probability for a recession within the next 1-2 years between 24 and 38 percent.

The role of central banks is increasingly a point of controversy – particularly in currencies where negative yields force investors to take more risk than they otherwise would. It is for sure that central banks cannot create social wealth. And they do not claim it. Some investors still believe it.

The dilemma right now is that some investors believe in a recession – with or without relief from central banks. And the investors that do not believe in a recession see further interest rate hikes which do depress financial market valuations.

Erwin Lasshofer and his INNOVATIS team expect a high probability for one of the two scenarios to materialize. For both cases markets have already reached a considerable discount. We still expect continued volatility for the rest of the year with moderate profits from here.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login