Weekly Newsletter #13/2015

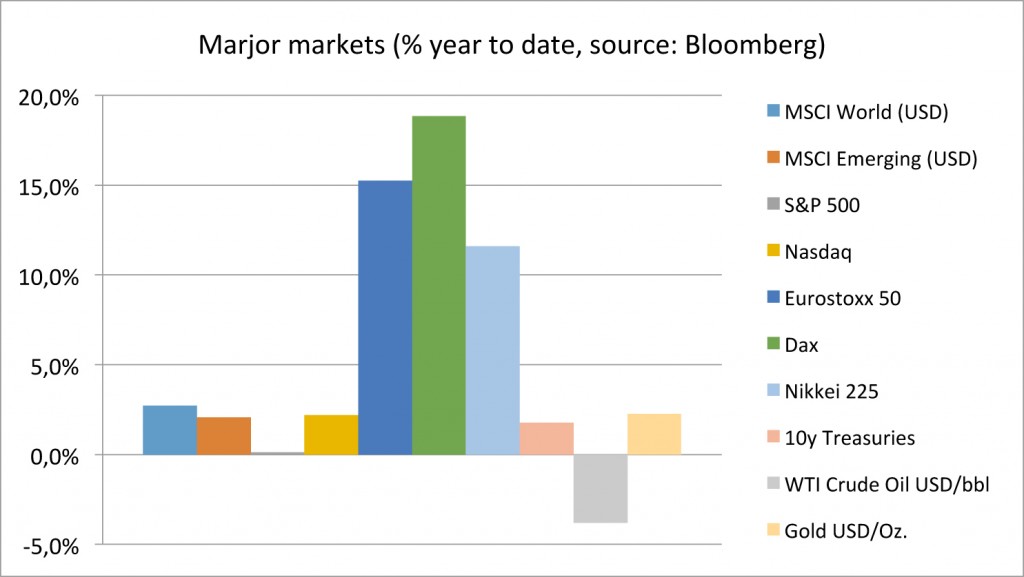

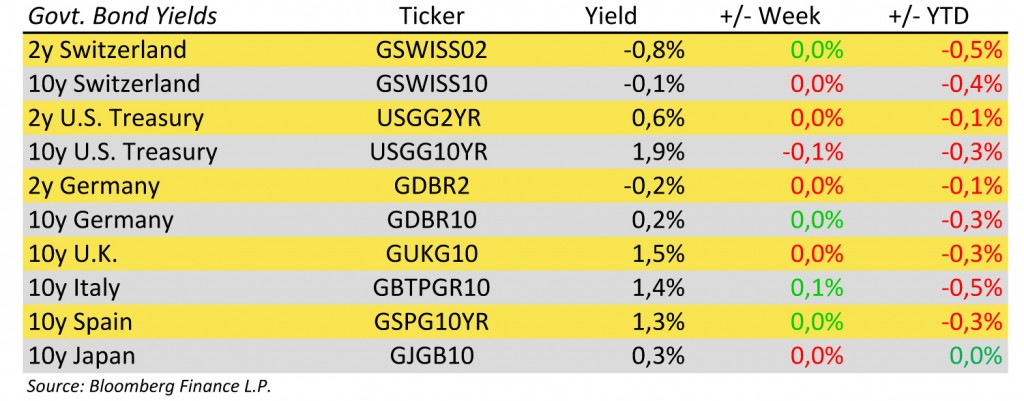

European equity markets have rallied for the last weeks since the ECB has flooded the market with money. The ECB and national central banks started buying sovereign debt under the 19-month plan to inject 1.1 trillion euros into the economy. The Euro fell as low as 1.05 versus US dollar which is a record in 12 years. This helped the German DAX30 equity index to jump above 12’000 points which marks an all-time high. Germany’s 10-year yield fell to a record low of 0.2%. And also US 10year Treasury yields have come down to 1.9%.

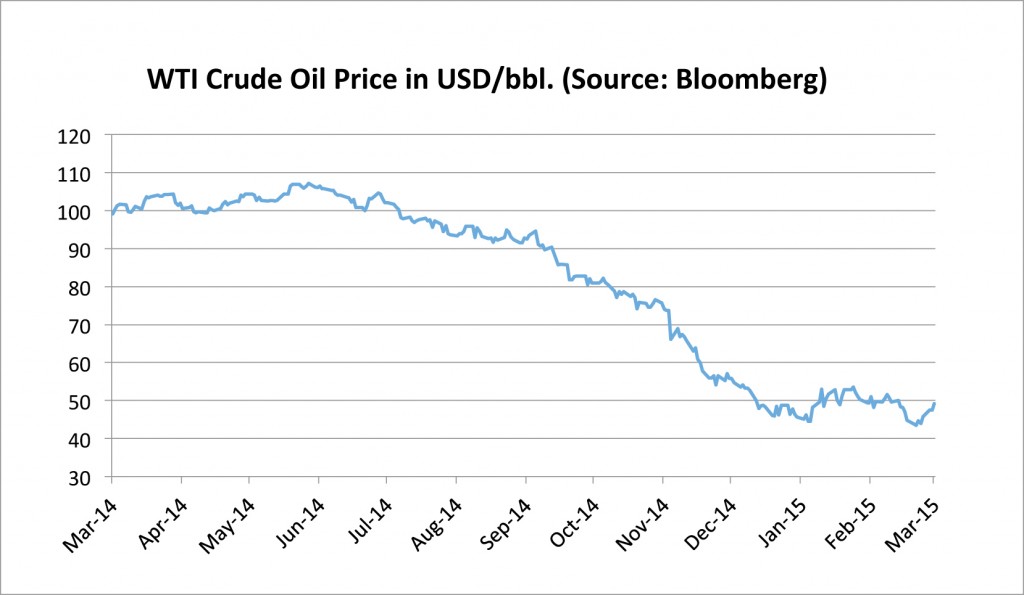

Erwin Lasshofer still does not believe in rate hikes anytime soon. The ECB is currently doing quite the opposite. And the US Fed can wait considering the low inflationary pressure which is also curbed by low crude oil prices – see our chart of the day.

Crude oil prices have suffered from US-production which is still increasing – albeit at a lower pace now. Technically crude oil could be bottoming out right now. Rising tensions in the Middle East might be the catalyst for a recovery. Some analysts argue that oil storages are exhausting which might put further pressure on the market.

We focus on investments with large safety margins in this sector. Currently we find great opportunities in structured products on oil stocks with very low capital and coupon barriers. See also our offer below.

Archives

- June 2019 (1)

- March 2019 (1)

- February 2019 (1)

- December 2018 (1)

- May 2018 (1)

- January 2018 (1)

- December 2017 (2)

- October 2017 (1)

- September 2017 (1)

- August 2017 (1)

- July 2017 (1)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (4)

- November 2016 (3)

- October 2016 (3)

- September 2016 (2)

- August 2016 (5)

- July 2016 (2)

- June 2016 (4)

- May 2016 (1)

- April 2016 (4)

- March 2016 (5)

- February 2016 (3)

- January 2016 (3)

- December 2015 (5)

- November 2015 (5)

- October 2015 (4)

- September 2015 (3)

- August 2015 (7)

- July 2015 (7)

- June 2015 (5)

- May 2015 (6)

- April 2015 (9)

- March 2015 (9)

- February 2015 (9)

- January 2015 (9)

- December 2014 (11)

- November 2014 (10)

- October 2014 (3)

- September 2014 (1)

- August 2014 (2)

- July 2014 (2)

Investor Login

Investor Login